Estimating Price Impact in Decentralized Exchanges

To properly evaluate price impact on a decentralized exchange (DEX), we’ll continue our analysis assuming zero trading fees. Consider a liquidity pool with:

Consider a liquidity pool containing:

- x₁: quantity of Token X

- y₁: quantity of Token Y

Price Dynamics Framework

Initial Price of Token Y:

When swapping x2 of Token X for y2 of Token Y, the received amount is:

Final Price Calculation:

Price Slippage Derivation

The percentage price slippage is determined by:

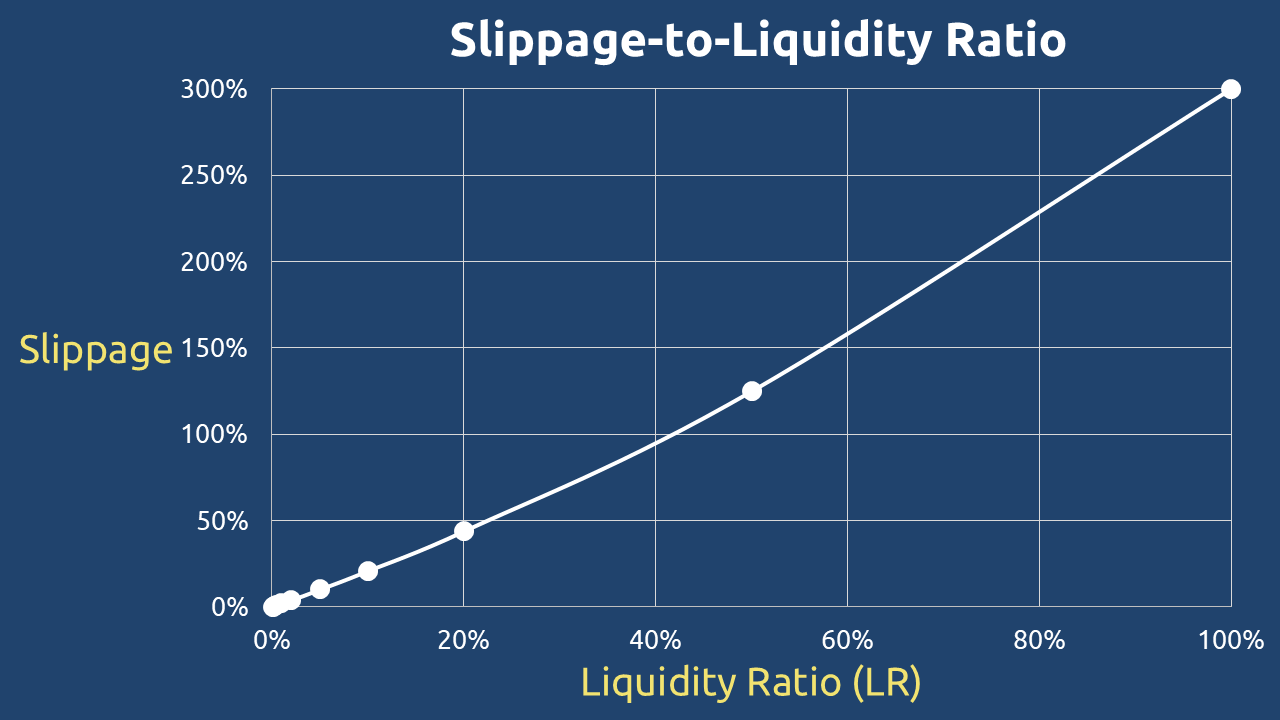

Liquidity Ratio (LR) Concept

Introducing the Liquidity Ratio:

We can express slippage purely in terms of LR:

Key Insights:

- Slippage depends solely on Token X liquidity parameters

- Independent of Token Y‘s pool quantity

- Quadratic relationship between LR and slippage

Reverse Calculation: LR from Target Slippage

The quadratic equation can be solved to estimate the target LR based on the target DEX Price Slippage.

Practical Application

Example Pool:

- QD(DAI) = 100,000 DAI

- QD(eGHST) = 10,000 eGHST

For 5% slippage:

or 2.649%

Optimal Trade Size:

This framework enables traders to precisely calculate expected price impacts and optimize their trade sizes in decentralized liquidity pools.