We now arrive at a crucial concept: how DEX trading fees compensate for Impermanent Loss (IL). While most sources vaguely mention this relationship, few explain the exact mechanics.

Let’s revisit our previous IL formula:

Now, we’ll adjust for price changes (d) and DEX fees.

Price Ratio (d) with DEX Fees

Define d as the price change ratio:

From this, we derive:

Multiply both sides by :

Since DEX fees increase k (without liquidity additions/withdrawals, only swaps), we use:

Substituting k1 and k2:

Solving for :

Plugging back into the IL equation:

Key Implications:

- If no swaps occur,

- If swaps occur,

(fees accumulate)

- The term

(DEX Liquidity Ratio, DLR) reduces IL impact

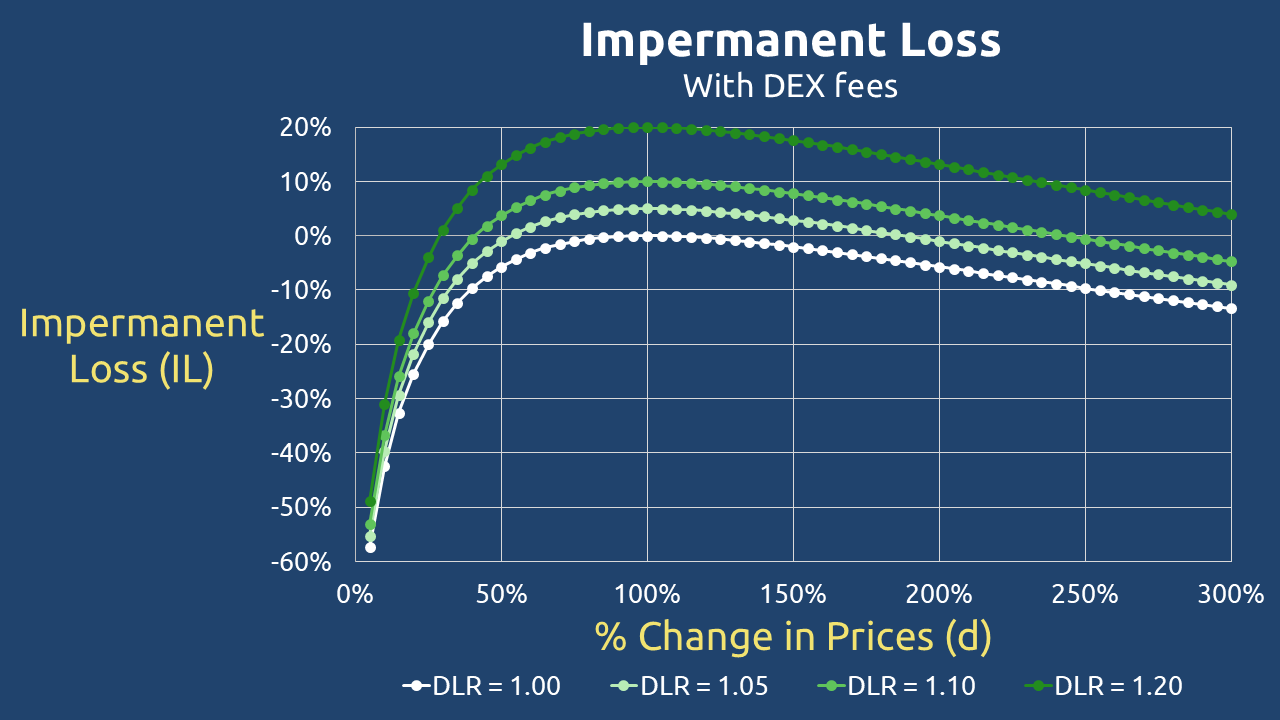

Numerical Examples: IL vs. DEX Fees

Define DLR (DEX Liquidity Ratio):

When DLR = 1.05

- d = 25% (Token X drops by 75%) → IL = -16.0%

- d = 50% (Token X drops by 50%) → IL = -1.0%

- d = 75% (Token X drops by 25%) → IL = 3.9%

- d = 125% (Token X rises by 25%) → IL = 4.3%

- d = 150% (Token X rises by 50%) → IL = 2.9%

- d = 200% (Token X rises by 100%) → IL = -1.0%

- d = 300% (Token X rises by 200%) → IL = -9.1%

✅ Profit Zone: d = 53% to 188%

When DLR = 1.10

- d = 25% (Token X drops by 75%) → IL = -12.0%

- d = 50% (Token X drops by 50%) → IL = 3.7%

- d = 75% (Token X drops by 25%) → IL = 8.9%

- d = 125% (Token X rises by 25%) → IL = 9.3%

- d = 150% (Token X rises by 50%) → IL = 7.8%

- d = 200% (Token X rises by 100%) → IL = 3.7%

- d = 300% (Token X rises by 200%) → IL = -4.7%

✅ Profit Zone: d = 41% to 243%

When DLR = 1.20

- d = 25% (Token X drops by 75%) → IL = -4.0%

- d = 50% (Token X drops by 50%) → IL = 13.1%

- d = 75% (Token X drops by 25%) → IL = 18.8%

- d = 125% (Token X rises by 25%) → IL = 19.3%

- d = 150% (Token X rises by 50%) → IL = 17.6%

- d = 200% (Token X rises by 100%) → IL = 13.1%

- d = 300% (Token X rises by 200%) → IL = 3.9%

✅ Profit Zone: d = 29% to 347%

Key Takeaways

- DEX fees reduce IL impact – Higher DLR (more fees) expands the profitable price range.

- Fee accumulation matters – Even with large price swings, sufficient fees can turn IL into gains.

- Practical insight – liquidity providers should monitor DLR to assess whether fees outweigh IL.