Prominent Web2.5 platforms – including industry heavyweights like Ledger, Bitget, Cryptomus, and Bitstamp – routinely classify assets such as Bitcoin, gold, and rare collectibles as deflationary. But how accurate is this characterization? A closer examination reveals critical flaws in this widely accepted narrative.

Origins of “Deflationary” in Crypto

Traditional economic theory doesn’t formally recognize assets as “inflationary” or “deflationary” based on supply mechanics. These terms were popularized by the cryptocurrency community, primarily to describe Bitcoin’s fixed issuance schedule.

- Deflationary Asset: A crypto-native concept referring to assets with a decreasing or capped supply.

- Inflationary Asset: Its counterpart – assets with an expanding supply (e.g., fiat currencies).

Yet, applying these labels to Bitcoin, gold, and other assets often misrepresents their true economic nature. The distinction matters – because when investors believe an asset is “deflationary,” they assume scarcity-driven price appreciation. But is that assumption justified?

Let’s dissect the reality behind these claims.

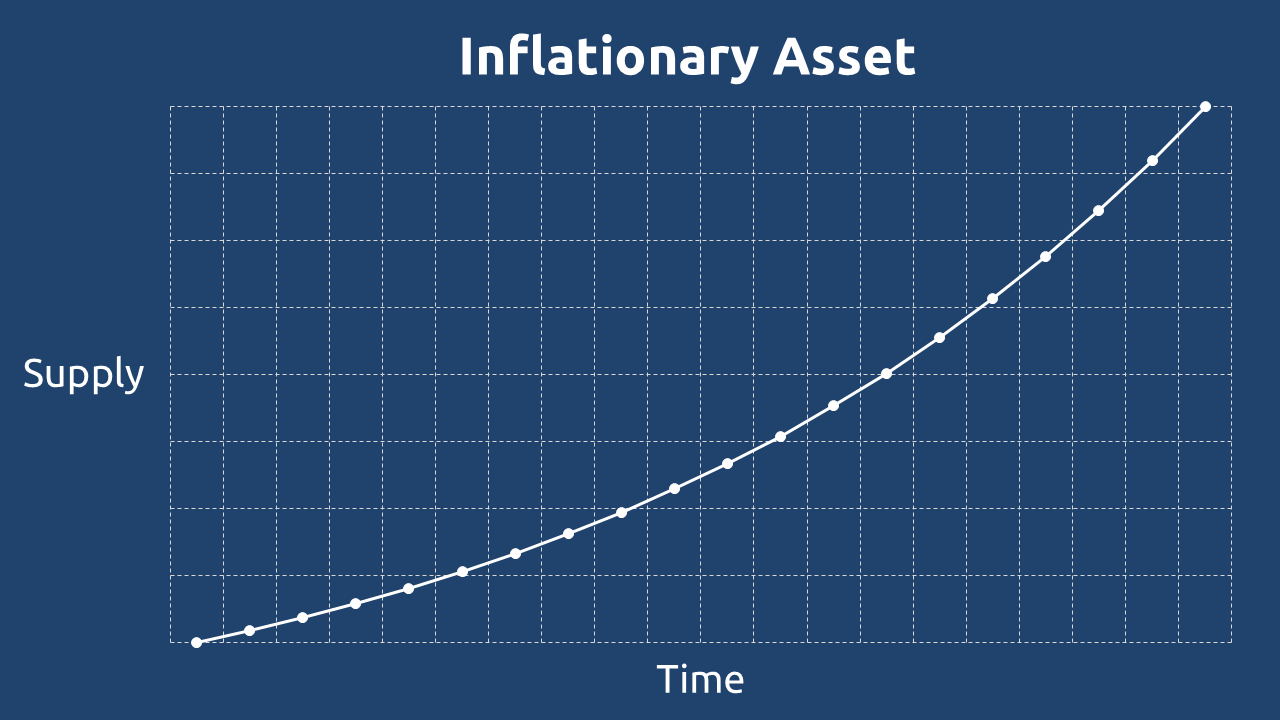

Understanding Inflationary Assets

By definition, inflationary assets are characterized by an expanding supply over time. The most prominent example is fiat currency, which faces no inherent constraints on issuance. While central banks may impose theoretical limits, in practice, governments can – and do – increase money supply without requiring proportional economic growth or commodity backing.

USD: A Case Study in Inflationary Design

As the world’s reserve currency, the USD exemplifies inflationary mechanics. The Federal Reserve tracks money supply through M2, which includes:

M1 Components:

- Physical currency in circulation

- Demand deposits (checking accounts)

- Other liquid deposits (savings accounts, money market accounts)

Plus:

- Small-denomination time deposits (<$100,000)

- Retail money market fund balances

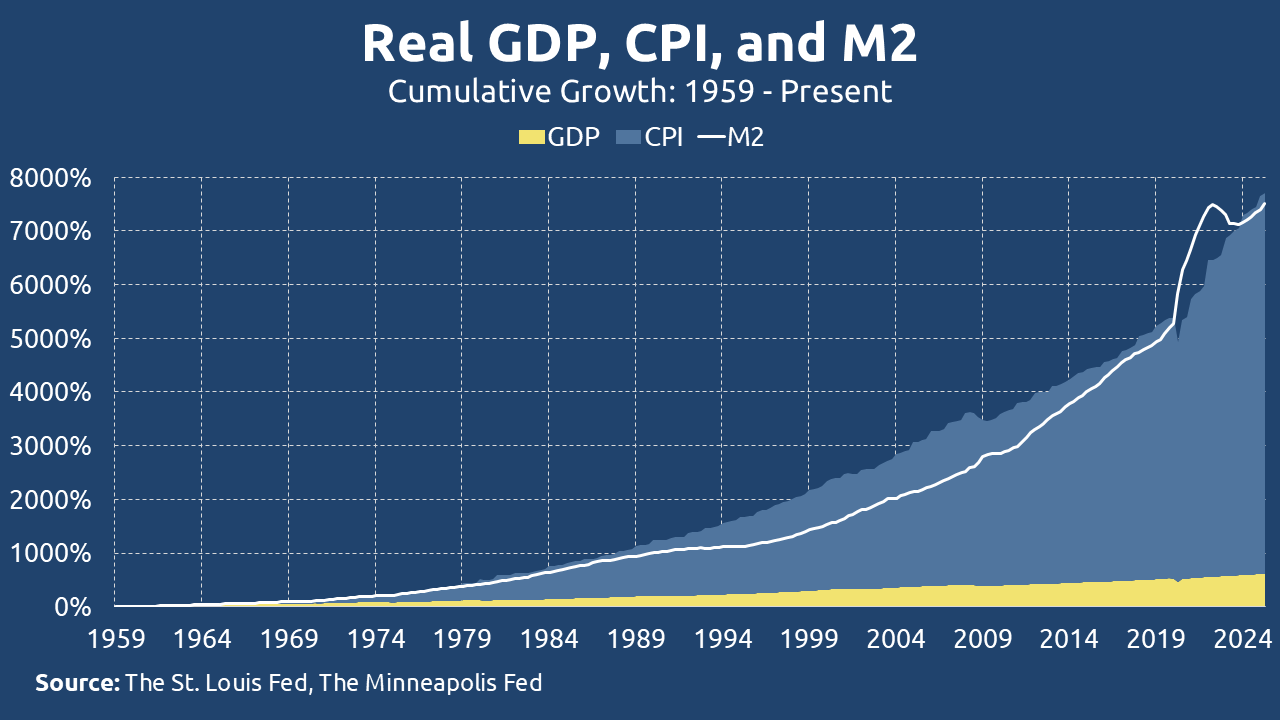

The Inescapable Math of Monetary Inflation

Since 1959, the M2 supply has grown at 6.8% annually – consistently outpacing GDP growth. Even when adjusted for economic output:

- Money supply continues expanding year-over-year

- Official CPI figures represent only the minimum inflation level when accounting for production

This data confirms the USD’s fundamentally inflationary nature – both in raw terms and when measured against economic productivity. Unlike assets with constrained supplies, fiat currencies face no natural barriers to devaluation through excessive issuance.

While cryptocurrencies often position themselves as inflation hedges, understanding fiat’s structural inflation helps explain why investors seek alternative stores of value. The USD’s endless growth trajectory underscores the appeal of assets with verifiable supply constraints.