The original OlympusDAO model relied heavily on decentralized stablecoins for treasury backing, primarily DAI and FRAX. At its inception, these assets represented a truly decentralized vision and held significant promise for broader adoption.

Over time, however, the Web3 landscape has shifted, increasingly influenced by what can be termed Web2.5 rivals.

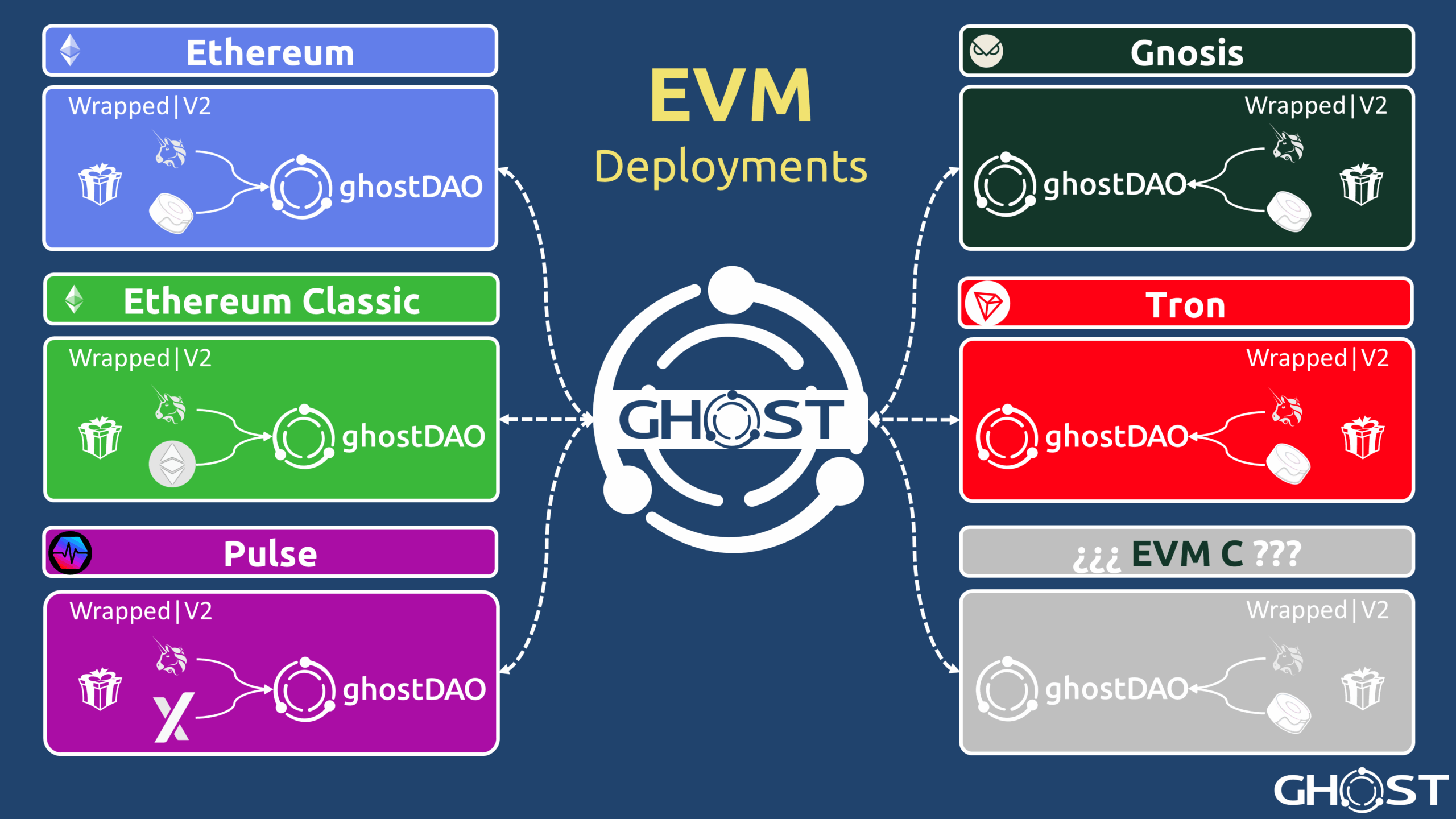

This evolution presents a unique opportunity for ghostDAO: to break from the legacy OlympusDAO framework and introduce a more resilient, multi-chain approach.

FRAX

FRAX, championed by OlympusDAO as a decentralized, algorithmic stablecoin, ultimately failed to achieve significant traction. Market attention shifted overwhelmingly toward centralized, censorable stablecoins like USDT, USDC, and the now-discontinued BUSD.

The story of MakerDAO, however, is far more complex and seldom discussed. Let’s examine the unusual circumstances surrounding its evolution.

DAI

MakerDAO, founded by Rune Christensen and Nikolai Mushegian, revolutionized DeFi with its DAI stablecoin. Before the term DeFi was even coined, DAI earned community respect for its innovative model: a USD-pegged stablecoin backed by 150% overcollateralization in assets like ETH, maintained through live auctions.

However, this success story took a dark turn. In October 2022, 29-year-old co-founder Nikolai Mushegian reportedly drowned after being caught in sea currents at a San Juan beach. His death came less than 24 hours after he posted a deeply troubling tweet suggesting he feared powerful enemies.

Following Mushegian’s death, MakerDAO began a clear pivot toward institutionalization, significantly increasing its reliance on centralized assets. While current data is obscured (the primary analytics site DaiStats is no longer functional), available information indicates approximately 60% of DAI’s backing came from USDC.

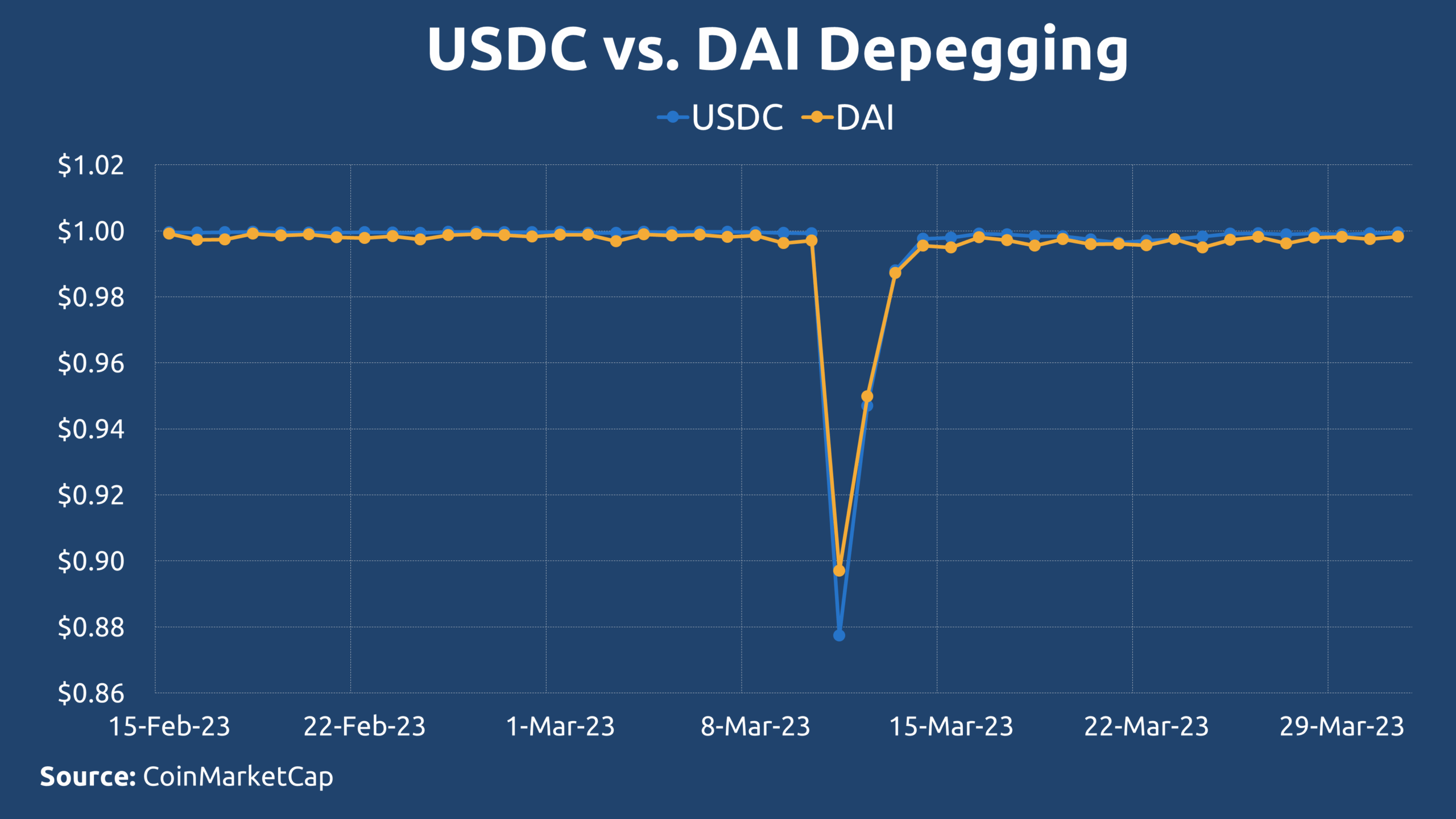

This shift had profound consequences. During the Silicon Valley Bank (SVB) collapse, USDC temporarily depegged, falling by 12%. DAI followed suit, dropping nearly 10%.

Surviving co-founder Rune Christensen has since advanced MakerDAO’s SKY proposal. SKY would introduce balance-freezing capabilities directly enabling KYC requirements and identity verification, fundamentally contradicting cryptocurrency’s core ethos of censorship resistance.

For example, Nikolai’s pinned post on Twitter can be found below:

Do you think that Nikolai would have supported such wholesale institutionalization of MakerDAO?

Stablecoin Multi-Chain Adoption

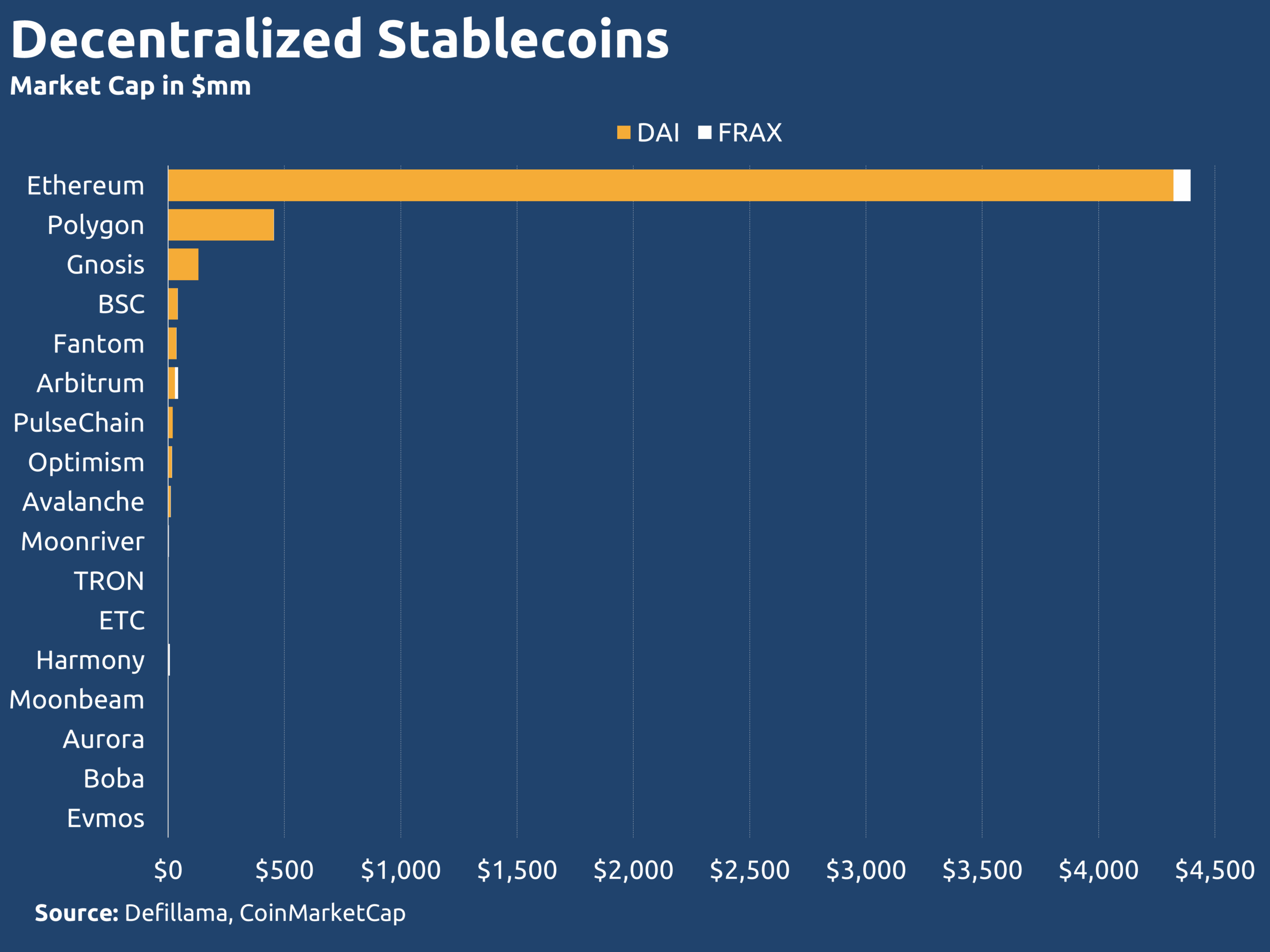

The stablecoin market has become dominated by USDT and USDC. The former operating with surprising regulatory immunity, the latter achieving full compliance. This duopoly has marginalized native crypto stablecoins like DAI and FRAX, whose adoption remains fragmented and limited across the multi-chain ecosystem.

Beyond Ethereum, Polygon, and Gnosis where DAI maintains a respectable ~$100 million market cap per chain, adoption drops significantly. Networks like BSC, Fantom, Arbitrum, and PulseChain show only about $20 million in DAI market cap. FRAX demonstrates even weaker distribution, with roughly $80 million on Ethereum and a mere $27 million spread across 12 other EVMs combined. This limited, uneven adoption makes decentralized stablecoins an unreliable foundation for a cross-chain treasury.

Native Coins

Native blockchain tokens represent the foundational layer of value, operating at the protocol level, while stablecoins function as secondary smart contracts built atop these native infrastructures.

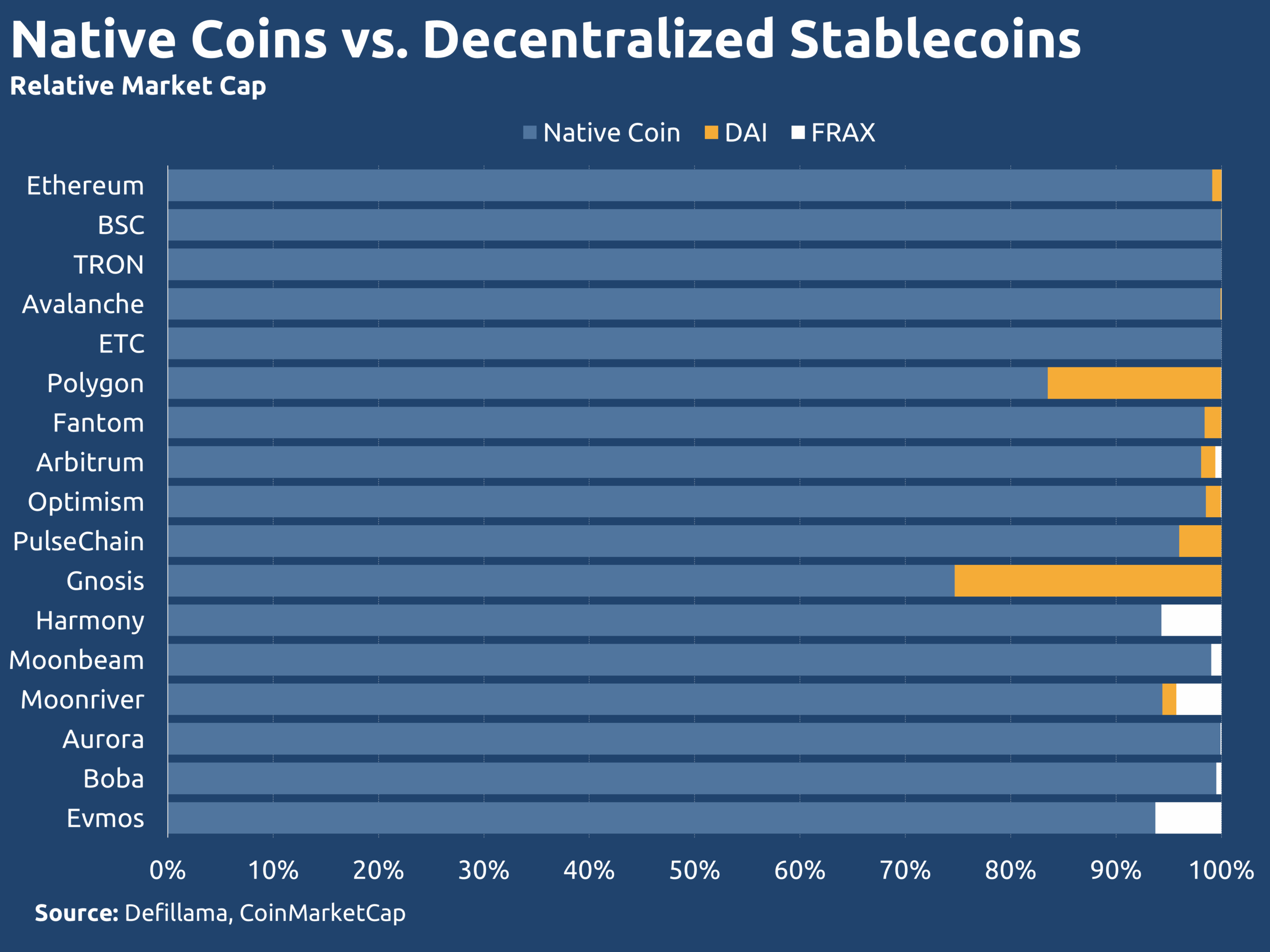

The data reveals sufficiently limited penetration by stablecoins. While Gnosis (34%) and Polygon (20%) show relatively higher stablecoin adoption, the average stablecoin market cap represents only 5% of native coin valuation across major EVM chains. This demonstrates that native coins remain the dominant value medium, with stablecoins occupying a niche rather than primary position in the ecosystem.

Why Now?

Native coins appear to be the obvious choice for treasury backing. This raises two critical questions: Why did the original OlympusDAO model favor stablecoins, and why wasn’t ghostDAO initially designed around native assets?

OlympusDAO emerged during a unique post-Covid macroeconomic environment characterized by unprecedented money printing, making stablecoin-backed treasuries appear as an illogical hedge against fiat devaluation. But crypto volatility was so extreme that stablecoins offered perceived interim safety during this period of uncertainty.

The initial ghostDAO design excluded native coins due to two seemingly insurmountable challenges that have only recently become addressable.

Variable Price Floor

Adopting native coins as treasury backing fundamentally alters the price floor mechanism. The legacy architecture maintained a fixed $1 floor by tethering eGHST supply to DAI-denominated reserves. eGHST minting ceases when Risk-Free Reserves (RFV) fall below 1 DAI per 1 eGHST.

With native coin backing, this floor becomes dynamic (in fiat terms). For example, if ghostDAO were deployed on Ethereum Classic with ETC at $20, 1 eGHST would be pegged to 0.05 ETC. The dollar-valued floor would then fluctuate with ETC’s price:

- If ETC rises to $40, the floor increases to $2 (0.05 × $40)

- If ETC falls to $10, the floor drops to $0.50 (0.05 × $10)

Critically, the price floor remains constant in the native asset’s terms (always 0.05 ETC), but becomes variable when measured in fiat terms.

Resolution

The optimal strategy for managing a variable price floor involves selecting EVM chains based on robust fundamentals rather than marketing hype. This requires replacing flashy advertising campaigns with deep analysis of real user activity, retention, and ideological alignment with a pure Web3 future.

Chains driven by speculation without clear differentiation or utility should be excluded from ghostDAO deployment in favor of sustainable, long-term ecosystems. This approach maximizes the probability of long-term price floor appreciation while minimizing depreciation risk.

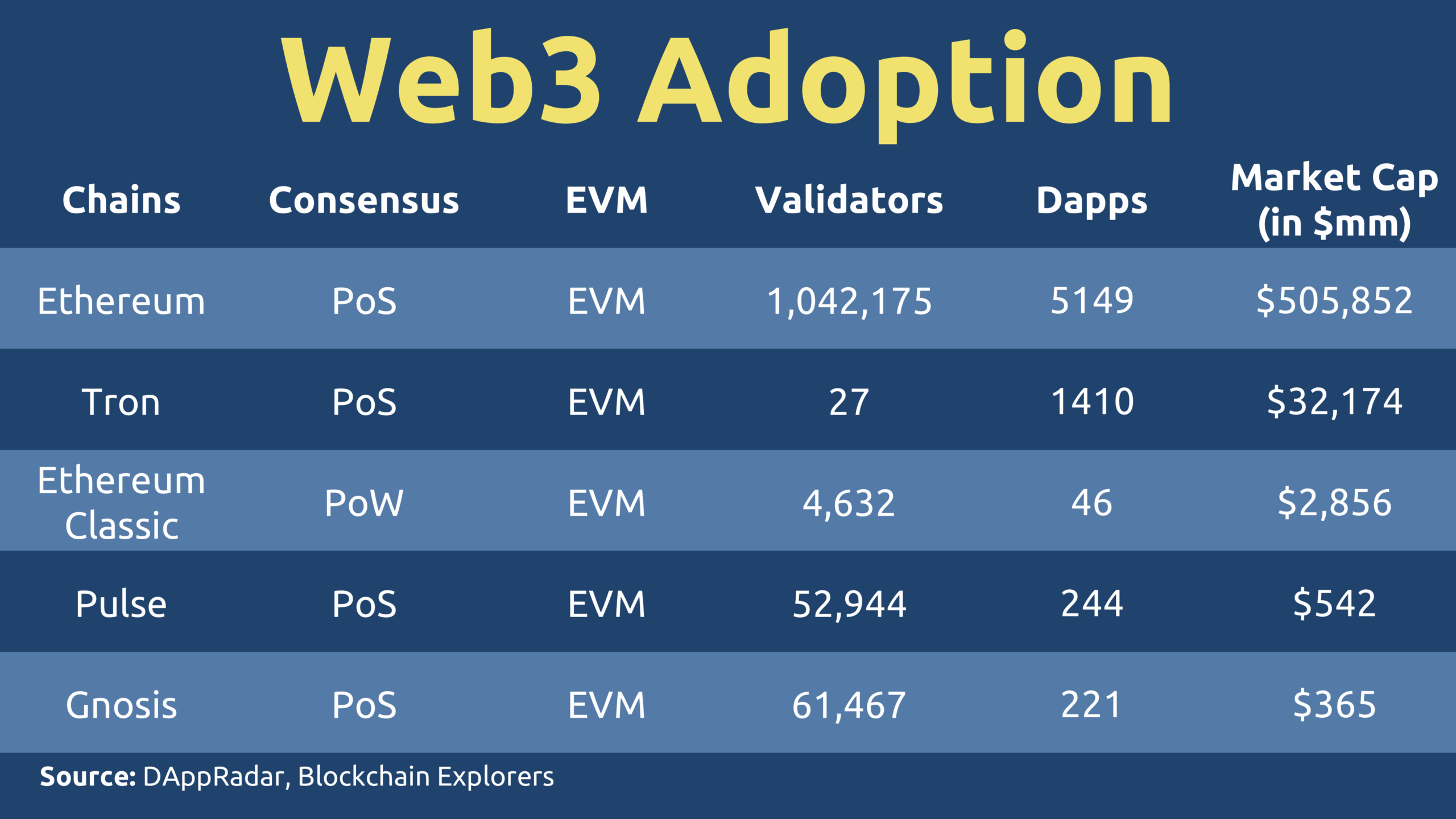

The following EVM networks represent potential candidates for ghostDAO deployment, selected for their proven infrastructure and community support rather than promotional activity.

Ethereum maintains clear leadership in both validator distribution and dApp ecosystem development. Pulse Chain (52,944 validators) and Gnosis Chain (61,467 validators) demonstrate exceptional network decentralization while each supporting over 200 dApps. Ethereum Classic maintains substantial network security with 4,632 validators, dramatically exceeding the typical ~100-node standard for the major blockchains.

Tron’s inclusion reflects its specialized positioning as the dominant settlement layer for global USDT transactions. Despite operating with only 27 validators, the network supports 1,410 dApps and processes substantial transaction volume through its established role in stablecoin transfers.

Inflationary Backing

The legacy ghostDAO architecture relies on stablecoin backing precisely for its stability. While DAI itself has no native token inflation, its value stability depends on the collateral backing it – primarily Ethereum and, increasingly, centralized assets like USDC. This creates an “inflation-backed-by-collateral” model where supply expansion remains tied to asset reserves.

By contrast, most native blockchain tokens feature built-in annual inflation—a characteristic that initially appeared to diminish their value as treasury assets and originally discouraged consideration of native coin backing for ghostDAO.

Realization

A crucial realization emerges: stablecoins are inherently inflationary. The fundamental oversight was recognizing that DAI, while stable in nominal terms, remains pegged to an inflationary US dollar. This means stablecoins provide stable inflation, not immunity from it.

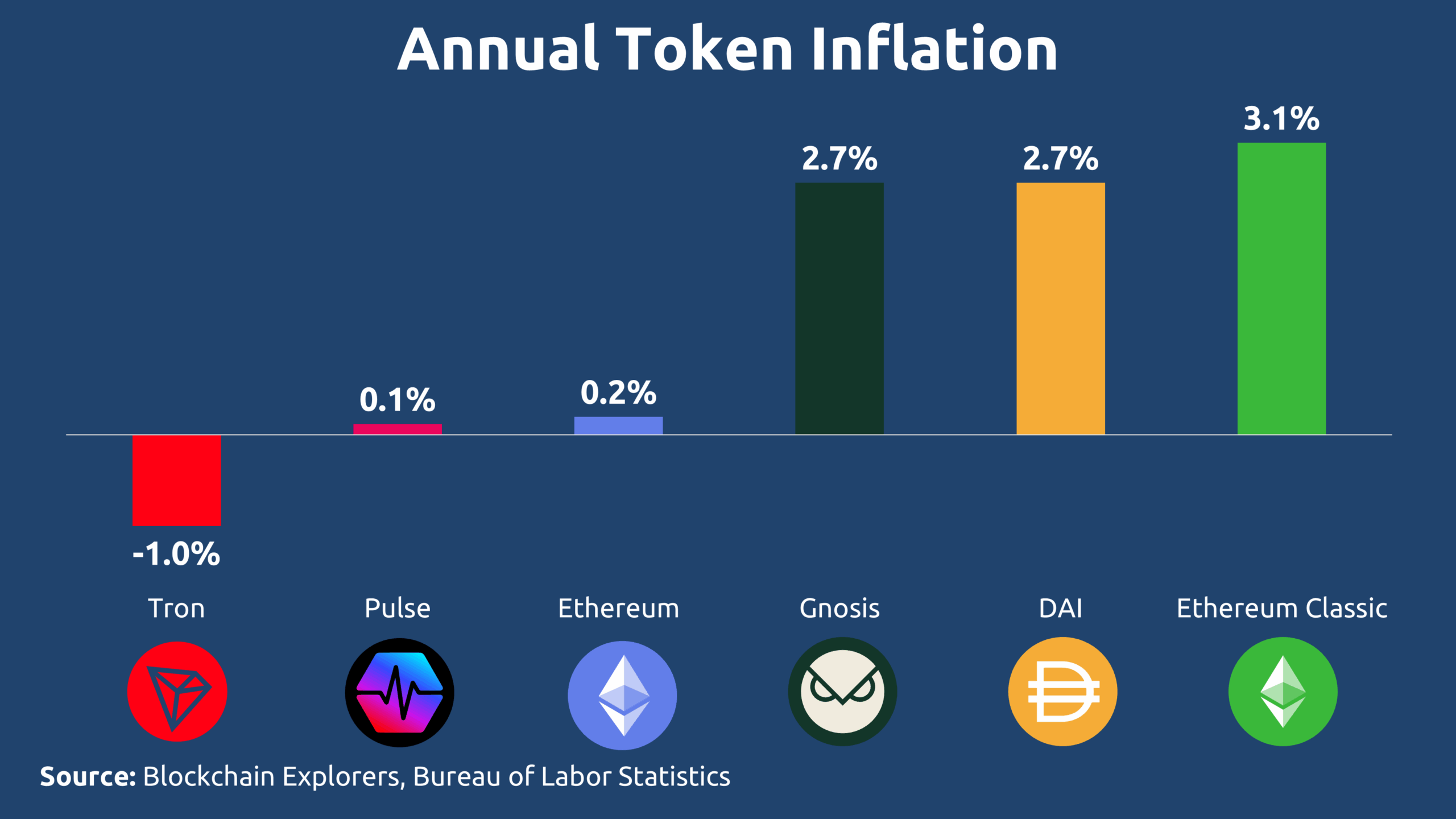

Official data as of Sep 2025 shows the dollar’s inflation is at least 2.7%, directly impacting DAI’s real value. Among the considered EVM chains:

- Ethereum Classic shows higher native inflation, though its emission schedule decreases by 20% every two years

- Gnosis utilizes xDAI, a DAI equivalent, maintaining stablecoin characteristics

- Tron demonstrates 0% deflation, creating positive pressure on treasury backing

- Ethereum and Pulse show negligible inflation, partially due to effective fee-burning mechanisms

This recalibration reveals that native coins and stablecoins both face inflationary pressures, just through different mechanisms.

Resolution

The defense against inflation – whether from fiat-backed stablecoins or native token emissions – lies in converting passive treasury assets into productive liquidity.

In case of stablecoin backing, the treasury would consist of DAI and eGHST-DAI LP tokens. In case of native coin backing, the treasury would consist of ETC and eGHST-ETC LP tokens.

The proposed solution systematically converts single-token reserves into productive liquidity positions through a mechanism that swaps half of the holdings for eGHST before deploying the paired assets to their respective DEX liquidity pools.

This strategy achieves three critical objectives:

- Generates yield through trading fees

- Compounds Protocol-Owned Liquidity (POL)

- Creates inflation-resistant backing where earned returns counterbalance purchasing power erosion

By transforming dormant assets into fee-generating positions, the treasury builds natural immunity against both dollar inflation and native token dilution.

Native Coins vs. Stablecoins

The choice between native coins and stablecoins for treasury backing requires examining several fundamental factors across different dimensions. The following analysis explores key parameters that distinguish these two approaches, providing a framework for evaluating their respective trade-offs in the ghostDAO ecosystem.

Availability

Decentralized stablecoins face significant availability constraints across blockchain ecosystems. A consistent ghostDAO architecture requires uniform backing assets across all deployed chains. Integrating different stablecoins (such as DAI on Ethereum and USDD on Tron) creates structural inconsistencies, despite GHOST Bridge facilitating 1:1 exchange between them.

Furthermore, many emerging and secondary chains lack sufficient stablecoin liquidity, creating operational bottlenecks for treasury management.

Native coins inherently solve these challenges. Their universal presence as gas tokens ensures built-in availability across all EVM chains, while their substantially deeper liquidity pools (as demonstrated in Figure 5) provide seamless convertibility and eliminate the fragmentation issues plaguing stablecoin-based systems.

Volatility

While stablecoins provide predictable inflation exposure, native coins introduce market volatility that fundamentally transforms the treasury’s relationship with the crypto ecosystem. Rather than resisting market cycles, a native coin-backed treasury naturally expands and contracts with the broader digital asset space, becoming an organic component of the crypto economy.

This volatility creates a powerful alignment mechanism: price fluctuations generate arbitrage opportunities that directly benefit GHOST validators through increased bridging fees. Higher bridging APY attracts more validators, strengthening network decentralization in a self-reinforcing cycle. This dynamic embodies true anti-fragility where market uncertainty actively fuels the growth and resilience of the GHOST ecosystem.

Price Manipulation

Stablecoins inherit the monetary policy vulnerabilities of their fiat counterparts, making them subject to central bank manipulation through inflation control. Additionally, their off-chain collateralization (exemplified by DAI’s USDC backing) creates perpetual depegging risks beyond protocol control.

Native coins face different manipulation vectors – primarily through foundation-level governance decisions and centralized exchange dominance. However, their integration within ghostDAO creates a countervailing force. By channeling native assets through GHOST Bridge and into protocol-owned liquidity, the system gradually shifts price discovery away from CEXes and toward decentralized venues. This migration from centralized to decentralized liquidity ultimately strengthens GHOST’s role as a pure Web3 connector while diminishing external manipulation capabilities.

Censorship

The censorship landscape reveals a critical divergence between asset types. Stablecoins like DAI have evolved from their censorship-resistant origins toward increasingly centralized control, with proposals like MakerDAO’s SKY upgrade introducing balance-freezing capabilities.

Native coins maintain a structural advantage: their fundamental protocols inherently prohibit balance freezing to preserve network integrity and prevent double-spending. While validator-level transaction censorship remains theoretically possible, this risk affects all asset types equally. The decisive factor becomes validator set decentralization. A sufficiently distributed and permissionless network provides robust censorship resistance for native assets, while stablecoins remain vulnerable to upstream regulatory pressure through their fiat-backed collateral.

Fees

The bridging workflow reveals a significant user experience advantage for native coins. With stablecoin backing, users must navigate:

The native coin path initially appears similar:

However, the critical distinction emerges when users already hold the backing asset. Native coin holders benefit from a streamlined process:

While stablecoin users enjoy a comparable shortcut:

Approximately 95% of on-chain value resides in native coins rather than stablecoins. Thus, the majority of users would naturally experience fewer transactions and lower fees with native coin backing. Switch to native coin backing will eliminate the initial conversion step that stablecoin-based bridging would still require. The total savings would add up to 0.6% in total DEX fees (0.3% on each side of the bridge).

Stablecoin Backing Tokenomics

The tokenomics for stablecoin-backed systems revolve around two core concepts: Risk-Free Value (LPRFV) and the Market Value (LPMV) of Liquidity Pool (LP) tokens, with their relationship expressed through a markdown factor.

The LPRFV represents the minimum, guaranteed value of the treasury’s assets, while the LPMV reflects their current worth on the open market. The markdown is calculated as the ratio of LPMV to LPRFV.

For detailed variable definitions and liquidity pool mechanics, please consult the ghostDAO glossary and LP fundamentals documentation.

The k constant is calculated as:

The price of DAI in terms of eGHST is given by the ratio of their reserves in the liquidity pool:

The protocol aims, at maximum expansion, for the quantity of eGHST to equal the quantity of DAI backing it:

Solving for QD(DAI):

Substituting QD(DAI) into the LPMV formula yields the RFV:

The markdown is then calculated as the ratio of the LPMV and RFV:

Native Coin Backing Tokenomics

The transition to native coin backing requires certain tokenomics tweaking. Coefficient is a new parameter defining the relationship between the native asset and its dollar value.

The coefficient is the exchange rate between the native coin and the stablecoin. It is defined as the number of DAI (or equivalent dollar-stable units) required to purchase one unit of the native coin. In essence, coefficient is the dollar price of the native coin.

The core value of the liquidity pool in native terms remains:

To express this value in the DAI-denominated terms necessary for the user interface, it is converted using the coefficient:

The k constant is calculated as:

The price of ETC in terms of eGHST is given by the ratio of their reserves:

The protocol targets, at maximum expansion, for the quantity of eGHST to match the dollar-equivalent value of the ETC backing it. This is where the coefficient enables the model:

Solving for QD(ETC):

Substituting QD(ETC) into the LPMV formula yields the RFV in ETC terms:

To get the RFV in DAI-denominated terms, the interface converts the ETC-denominated RFV:

Finally, the markdown is simply the ratio of LPMV to RFV:

Summary

A world unified under a single standard – like the American burger – offers the apparent benefit of stability through conformity.

But there exists a richer reality where diverse options coexist: Italian pizza, Turkish doner, Argentine asado, and Nigerian jollof rice. This diversity becomes not just preferable but essential when the dominant standard itself becomes compromised. Just as the US dollar, and by extension DAI, is now being undermined by central bank manipulation.