At the heart of the GHOST ecosystem lies the GHST asset – but is it a coin, a token, or something more nuanced? While its tokenomics might seem straightforward in a single-chain ghostDAO context, the dynamics become far more compelling when examined through a multi-chain lens.

This brings us to an essential distinction: GHST exists in two forms – as both a native blockchain coin and a cross-chain token. Understanding this duality is crucial for grasping GHST’s full economic potential. Let’s begin by clarifying this fundamental separation of roles.

Coins vs. Tokens

In blockchain ecosystems, coins and tokens serve fundamentally different roles, each with distinct technical and economic implications.

Coins are native assets of their own blockchains, serving as the foundational currency for network operations. Their primary functions include:

- Paying transaction fees (gas)

- Securing the network through staking or mining

- Acting as the base monetary unit

Key examples include BTC on Bitcoin (transaction settlement) and ETH on Ethereum (gas and smart contract execution).

Tokens, by contrast, are secondary assets created on existing blockchain platforms. They derive their security and functionality from the underlying chain while enabling specialized use cases:

- Stablecoins: Price-stable assets (e.g., DAI)

- Governance: Voting rights in DAOs (e.g. UNI)

- Speculative: Meme coins (e.g. PEPE)

- NFTs: Digital collectibles (e.g. JML)

This structural difference – coins as infrastructure, tokens as application-layer instruments – frames GHST’s dual role in the GHOST ecosystem.

GHST Coin vs. GHST Token

The GHOST Ecosystem pioneers a breakthrough in Web3 interoperability with GHST – an asset that functions simultaneously as both a native blockchain coin and a cross-chain token. This dual architecture enables seamless movement between layers of the ecosystem while maintaining distinct utilities in each form.

GHST Coin: The Native Fuel of GHOST Chain

As the foundational asset of its own blockchain, GHST Coin serves critical network functions:

- Network Fuel: Powers transactions via gas fees

- Validation Incentives: Validators bond GHST to secure the network and earn rewards

- Nomination System: Users can delegate (bond) GHST to validators for passive income

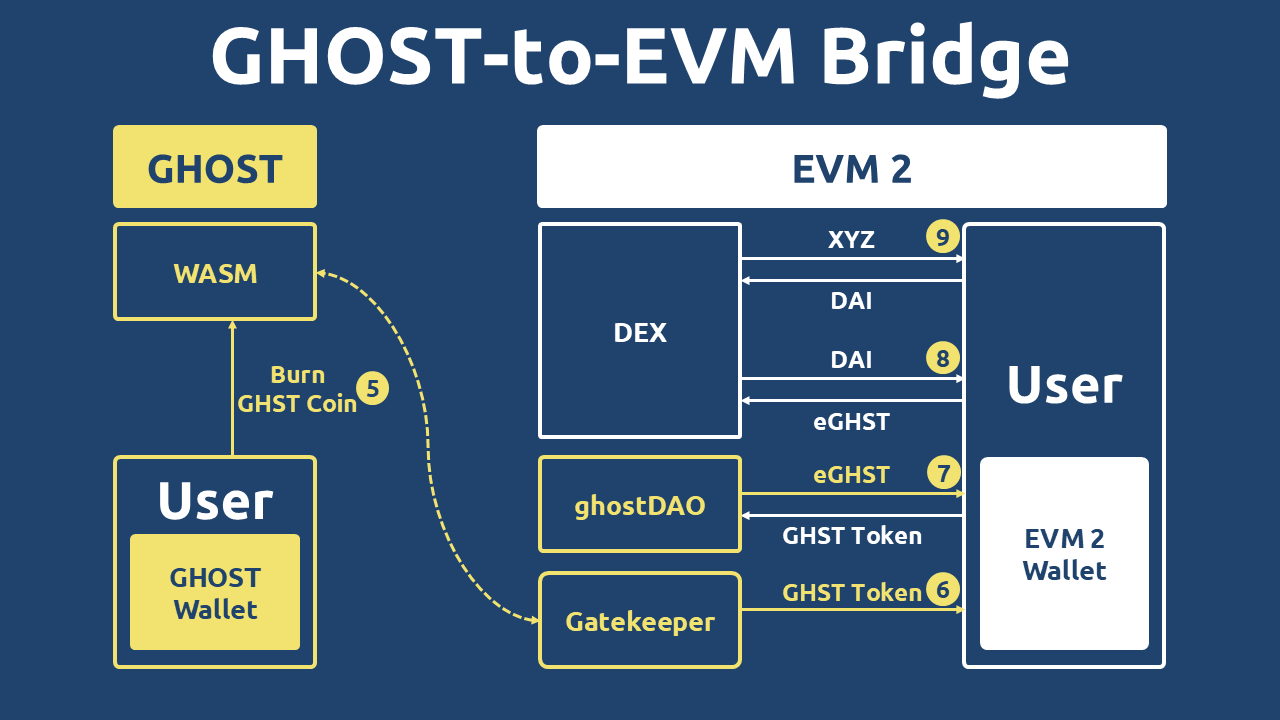

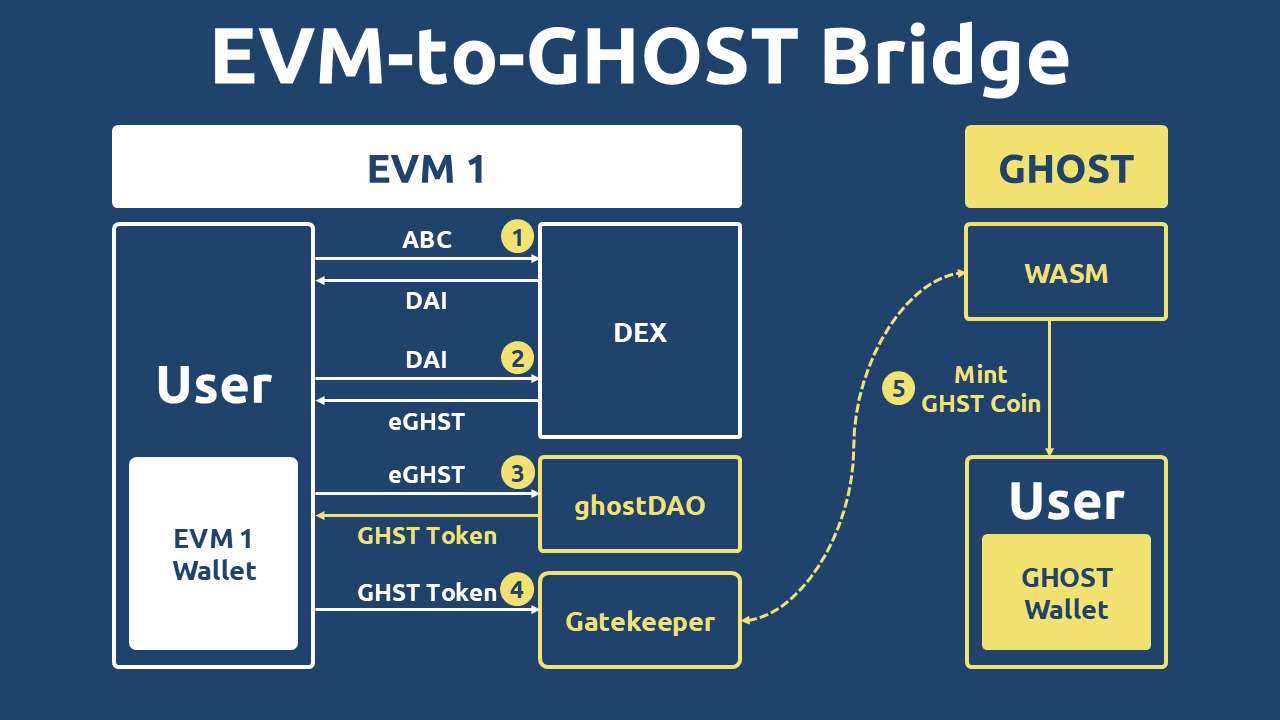

- Chain Bridging: Facilitates transfers to EVM-compatible networks (See Figure 1)

GHST Token: The Governance Engine on EVMs

When bridged to Ethereum Virtual Machine (EVM) chains, GHST transforms into a versatile protocol token:

- DAO Governance: Voting rights in ghostDAO decision-making

- Staking Rewards: Earn yields by participating in protocol security

- Reverse Bridging: Enables return flows to the native GHOST Chain (See Figure 2)

This symbiotic design positions GHST as a unique hybrid asset – combining the monetary properties of a base-layer coin with the programmability of a cross-chain token. The bidirectional bridges create an economic flywheel, allowing value and functionality to flow freely between the GHOST Chain and external ecosystems.

GHST Interoperability

GHST represents a groundbreaking innovation in Web3 as the first fully interoperable digital asset, seamlessly transitioning between its coin and token forms through a trustless bridging mechanism.

The conversion between GHST Token (EVM) and GHST Coin (GHOST Chain) maintains near-perfect parity.

From Token to Coin

From Coin to Token

This fluid interchangeability unlocks unprecedented cross-chain utility, enabling:

- Novel DeFi compositions combining L1 and L2 benefits

- Expanded governance possibilities across ecosystems

- Arbitrage opportunities between chain-specific markets

Remarkably, while GHST Coin and GHST Token exist as distinct instances operationally, they share identical economic properties – creating a unified monetary policy across chains. This duality embodies the core innovation of the GHOST protocol: a single asset with multi-chain consciousness.

The implications are profound – GHST doesn’t just bridge chains, it fundamentally redefines what a blockchain asset can be. This isn’t mere interoperability – it’s the first true manifestation of a cross-chain native currency, where the same economic entity exists simultaneously in multiple dimensions while maintaining perfect synchronicity.

Single-Chain Elasticity

The stability and value of GHST within every EVM are governed by a sophisticated treasury-backed system. Here’s how it works.

Treasury Backing & Governance

The ghostDAO Treasury serves as the foundational reserve backing eGHST, which in turn supports GHST tokens. This treasury can hold a diversified basket of assets, including:

- Stablecoins (e.g., DAI)

- Liquidity pool tokens (e.g., eGHST-DAI LP, GHST-DAI LP)

- Native blockchain coins (e.g., ETH, BNB, POL)

- Other strategic assets

Governance decides the exact composition, allowing flexibility in risk management and yield optimization.

The GHST-eGHST Peg Mechanism

The price of GHST is algorithmically derived from eGHST via a dynamic index:

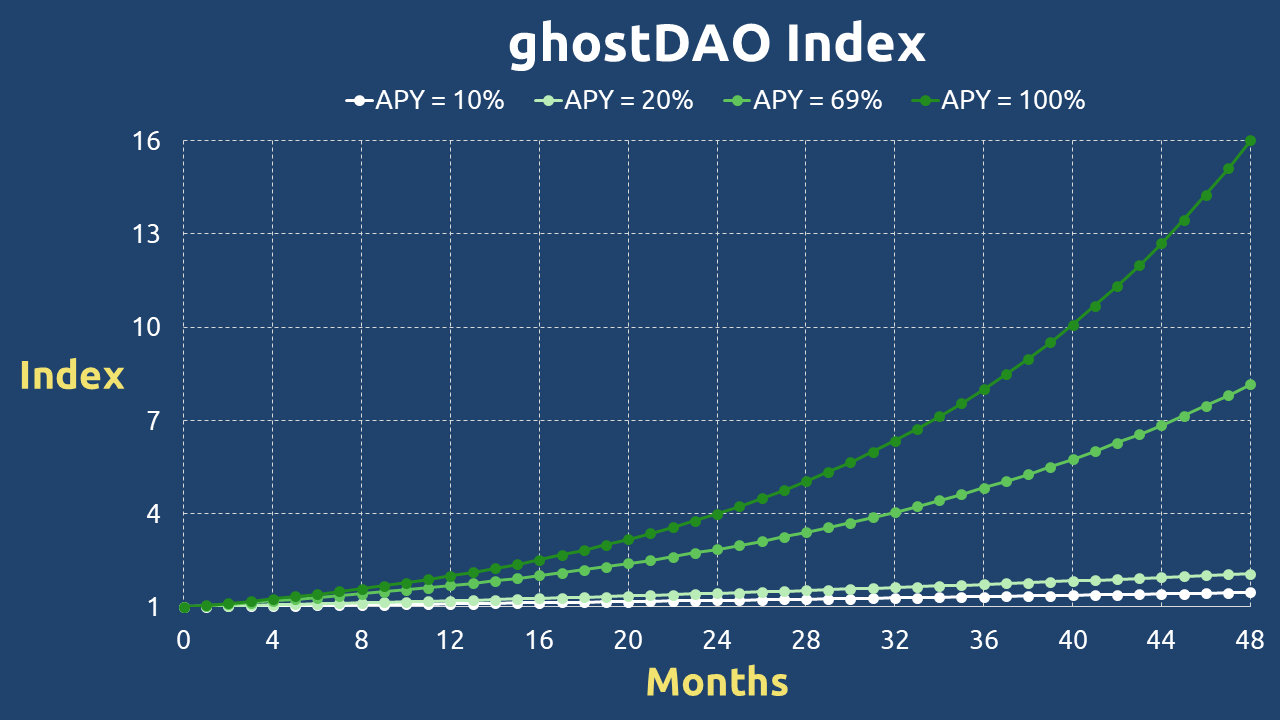

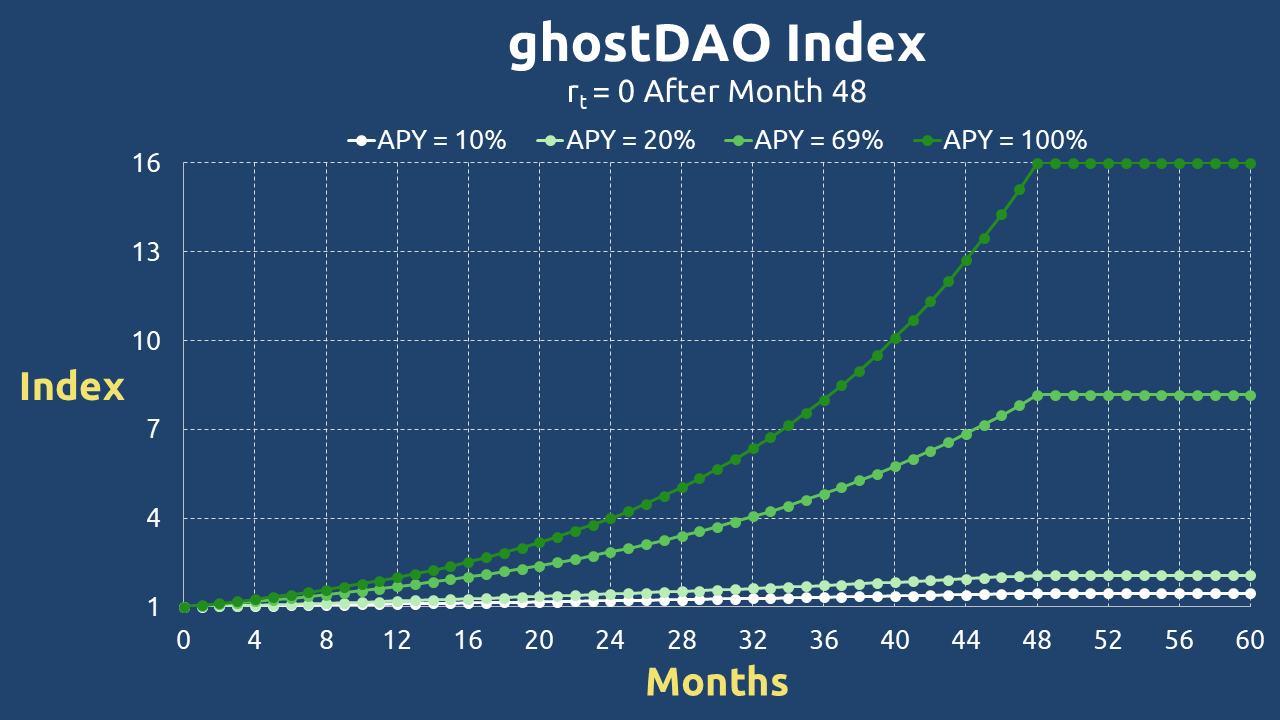

Where the Index accumulates rebase rewards over time:

- rt = 8-hour rebase APY (set by ghostDAO)

- t = Time since ghostDAO launch

- T = Current time

Programmatic Rules for Rebase (rₜ)

The rebase rate rt follows a conditional logic:

RFV (Risk-Free Value)

Ensures that rebases only occur when the treasury is sufficiently collateralized.

Governance Control

ghostDAO can adjust the RFV floor to halt inflation if reserves dip below a safety threshold.

Implications for Elasticity

Non-Negative Rebases

Since rₜ ≥ 0, the Index never decreases – only grows or remains flat.

Growth Phase (rₜ > 0)

The Index compounds, increasing GHST’s value relative to eGHST.

Stability Phase (rₜ = 0)

The Index plateaus, freezing GHST’s price appreciation until reserves improve.

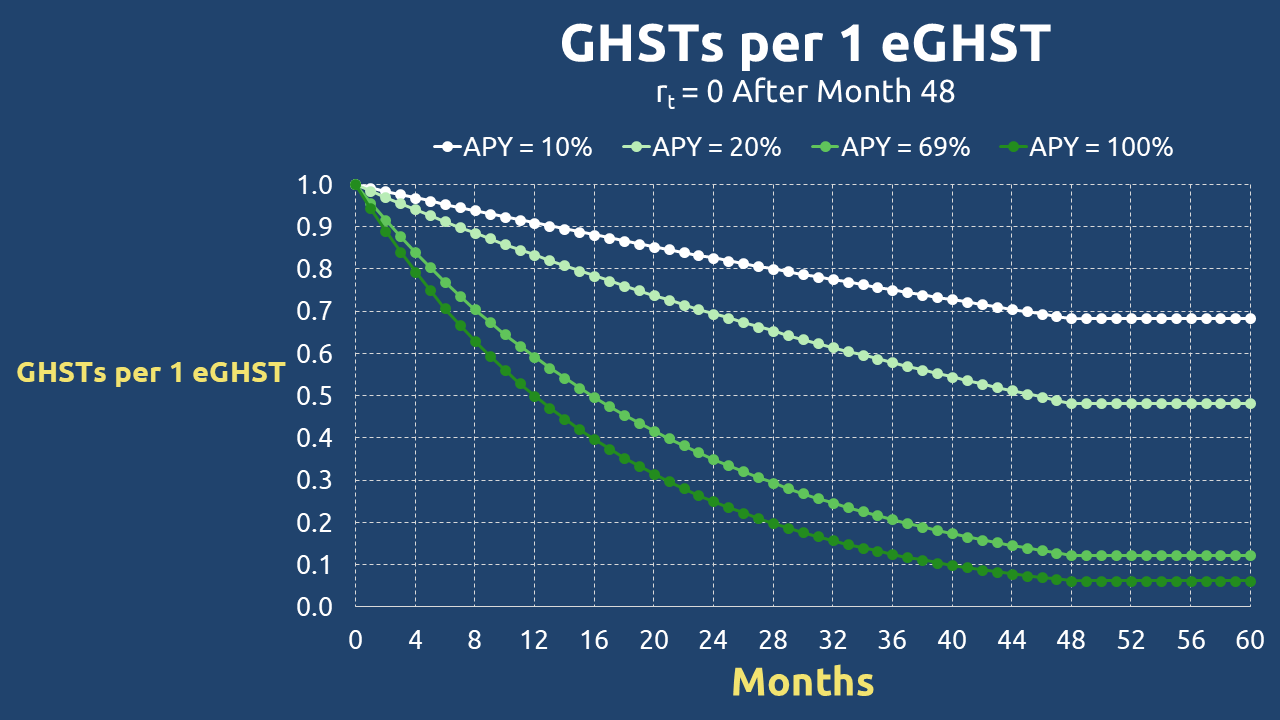

Figures 3 & 4 illustrate the Index behavior under different RFV conditions.

rₜ > 0

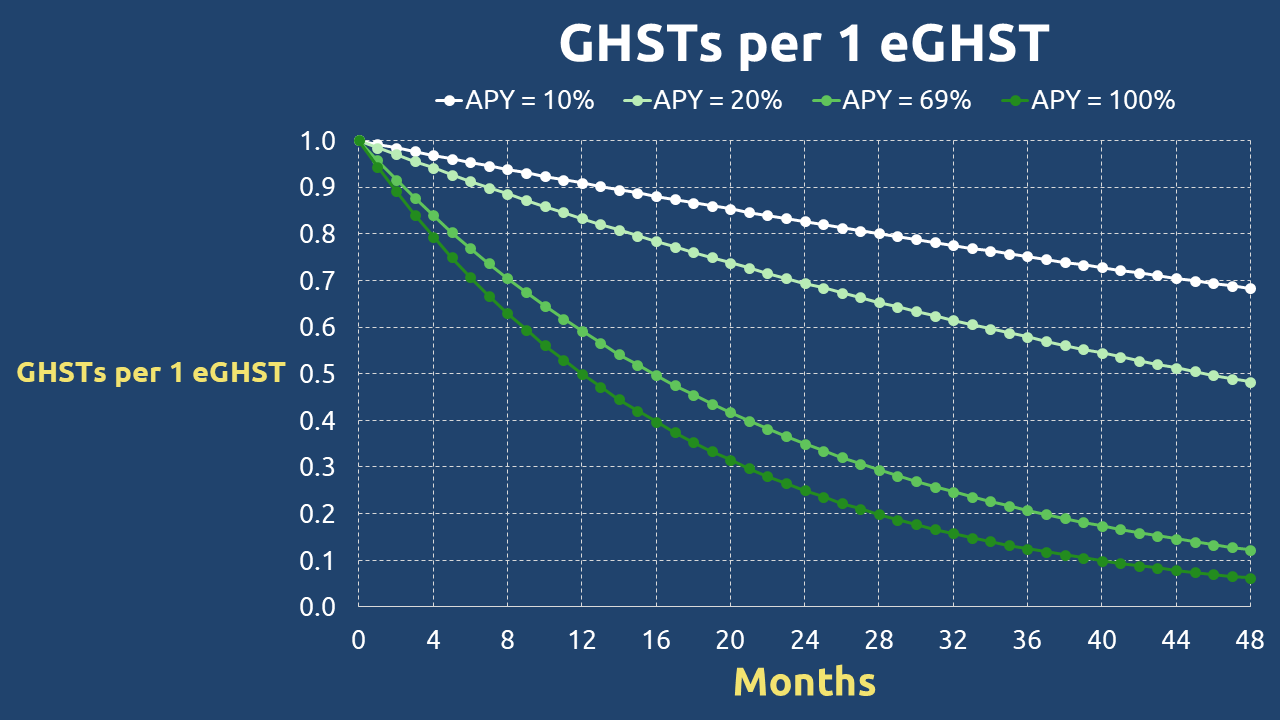

When the protocol generates positive yields (rt > 0), the system enters an expansion phase where eGHST supply grows elastically through periodic rebases occurring every 8 hours. However, this elastic expansion of eGHST reinforces GHST’s inelastic nature.

As shown in Figure 5, the increasing Index value means each subsequent rebase requires more eGHST to mint a single GHST, effectively creating a diminishing supply curve for GHST despite eGHST’s expansion.

rₜ = 0

The protocol’s equilibrium state (rt = 0) triggers a complete supply freeze, as illustrated in Figure 6. In this phase, both eGHST and GHST transition to fully inelastic assets with fixed supplies.

This dual-phase operation ensures GHST maintains inherent scarcity regardless of protocol activity. The key insight is that GHST’s supply remains inelastic in both operational modes – during expansion phases through its mathematically enforced scarcity mechanism, and during equilibrium through complete supply fixation.

Multi-Chain Elasticity

The elasticity principles governing GHST maintain consistency across chains. Just as with eGHST’s multi-chain behavior, GHST tokens preserve their core monetary properties in all deployments – each ghostDAO protocol instance follows identical Index growth mechanics, whether expanding or reaching equilibrium.

The more intriguing scenario emerges when examining GHST Coin’s unique supply characteristics. The protocol enables complete consolidation of GHST Tokens through bridging to the native GHOST Chain, creating a maximum possible supply scenario expressed by:

This equation reveals two fundamental truths about the system’s design:

- Fixed Foundation: The genesis supply allocated to initial validators represents an immutable base

- Supply Conservation: Bridged GHST Tokens don’t create new supply – they simply transform existing inelastic tokens into coins

This architecture ensures GHST Coin inherits the inelastic properties of its token counterparts, whether examining short-term fluctuations or long-term projections.

Summary

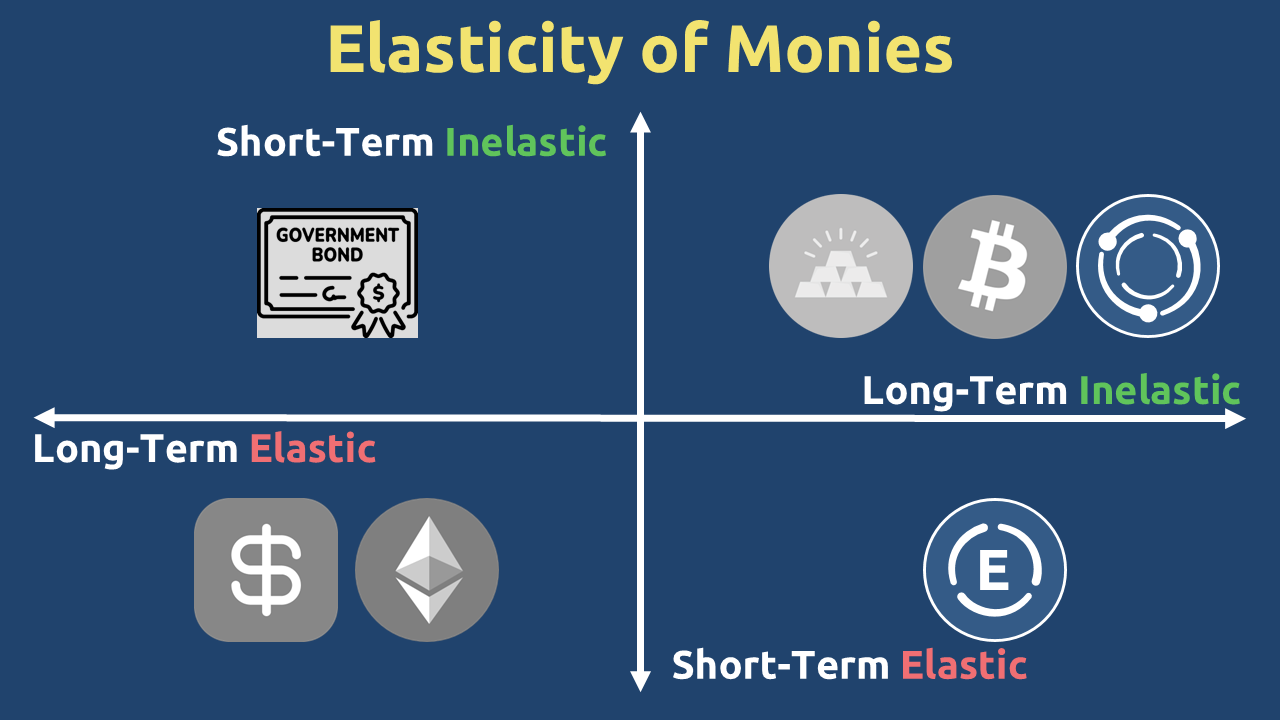

The elasticity framework reveals how GHST occupies a unique position among major monetary assets:

| Money Type | Short-term | Long-term |

| Fiat | Elastic | Elastic |

| Treasuries | Inelastic | Elastic |

| Gold | Inelastic | Inelastic |

| Bitcoin | Inelastic | Perfectly Inelastic |

| Ethereum | Elastic | Elastic |

| eGHST | Elastic | Inelastic |

| GHST | Inelastic | Inelastic |

This elasticity structure demonstrates that GHST maintains inelastic supply properties in both the short and long term – mirroring the behavior of traditional reserve assets like gold and Bitcoin, which are prized for their scarcity and stability.

Given that Bitcoin has already established itself as a mainstream digital reserve asset, an important question arises: Does GHST offer any unique monetary advantages?

We will explore this in the upcoming articles.