Are You a GHOST?

Maybe you’ve never heard of GHOST – or maybe you’ve been in crypto for years but still feel something’s off.

Bitcoin promised freedom. Ethereum promised decentralization. But look where we are now:

- Central banks co-opting crypto for CBDCs.

- Exchanges begging regulators for approval.

- “Web3” projects storing your keys, enforcing KYC, and bending the knee to the very systems crypto was meant to escape.

It’s schizophrenic. A revolution… that’s asking permission?

But not all projects sold out. A rare few still fight for real decentralization – no compromises, no backdoors, no institutional handshakes.

Are you one of us?

This test isn’t about shilling a coin. It’s about answering one question:

Do you still believe crypto can be uncensorable, private, and truly free… OR have you accepted the watered-down corporate version?

If the former… you might be a GHOST.

GHOST Test

Every second spent hesitating makes the surveillance state stronger. Prove your allegiance to real privacy – take the GHOST test now.

1. What role should governments play in cryptocurrency?

- Ban or heavily regulate it – it’s too risky.

- Regulate to prevent fraud but allow innovation.

- Minimal interference – let markets decide.

- Crypto should replace state-controlled money entirely.

2. How important are privacy coins or anonymous transactions?

- Dangerous – they enable crime.

- Useful in some cases but need oversight.

- Essential for personal freedom.

- Critical for resisting financial surveillance.

3. Where do you store most of your wealth?

- Banks, stocks, and real estate.

- A mix of traditional and crypto assets.

- Mostly in crypto (BTC, ETH, DeFi).

- In decentralized, censorship-resistant assets (self-custody, DAOs).

4. How do you approach crypto investments?

- Avoid them – too volatile.

- Only Bitcoin/ETH as a small portfolio hedge.

- Actively trade, stake, and use DeFi.

- Invest in disruptive Web3 projects (DeFi, privacy, parallel economies).

5. Should people have sovereign control over their digital identity?

- No, governments/companies should verify identity.

- Some balance between privacy and regulation.

- Yes, decentralized identity (DIDs) is the future.

- Absolute self-sovereignty – no KYC, no tracking.

6. Can crypto truly change the world?

- No, it’s just a speculative asset.

- Maybe in finance, but limited elsewhere.

- Yes – DeFi, DAOs, and uncensorable money matter.

- It’s our best tool to dismantle corrupt systems.

7. How do you view government-issued digital currencies (e.g. CBDC)?

- Good – safer than unregulated crypto.

- Useful if properly regulated.

- Dangerous – they enable surveillance.

- A threat to financial freedom; must be resisted.

8. How do you approach capital allocation?

- Set-and-forget (index funds, long-term holds).

- Balanced portfolio with occasional adjustments.

- Actively seek asymmetric opportunities (early-stage bets).

- Proactively engage with community to make sensible impact.

9. How important is anonymity online?

- Not important – I have nothing to hide.

- Somewhat important for sensitive matters.

- Very important – privacy is eroding.

- Essential; surveillance capitalism must be resisted.

10. Do you feel a personal responsibility to change systems you disagree with?

- No, systems are too big to change.

- Voting and donations are enough.

- Yes, through entrepreneurship or investment.

- Yes, even if it means subverting corrupt structures.

11. Should individuals have full control over their assets without third-party restrictions?

- No, oversight prevents abuse.

- Some restrictions are necessary.

- Yes, absolute ownership is a right.

- Yes, and we should build systems that enforce this.

12. What will dominate global finance in 10 years?

- Traditional banks and fiat.

- A mix of fiat and regulated crypto.

- Decentralized crypto and DeFi.

- Parallel, uncensorable economies outside state control.

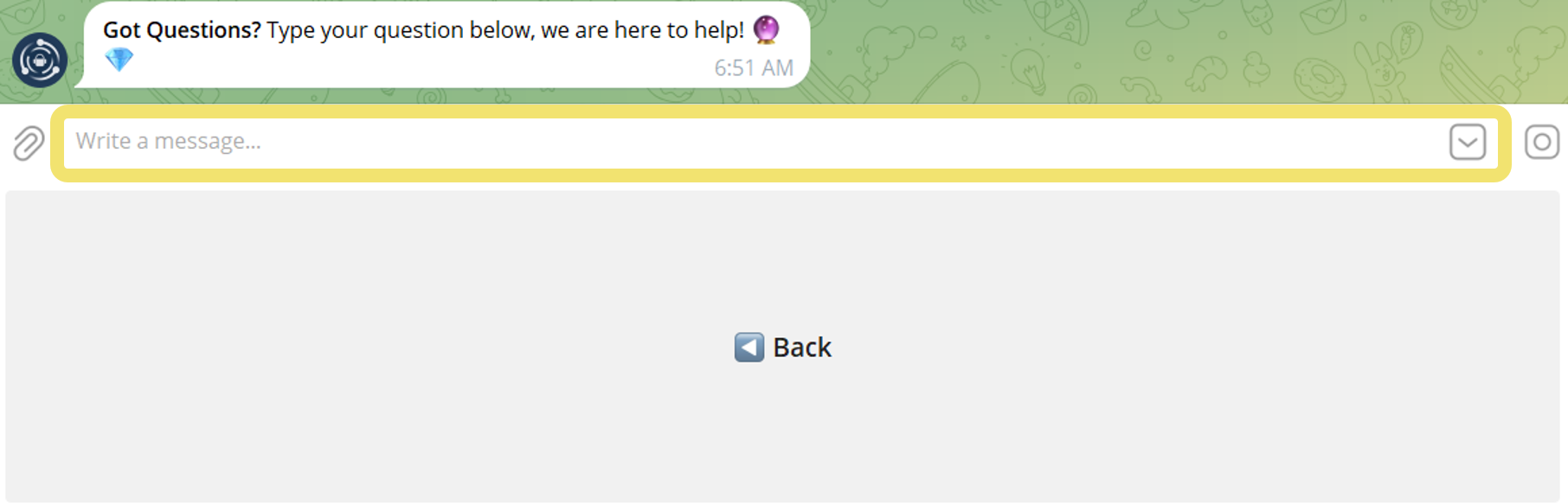

How to Submit Your Answers?

Step 1

Register in the ghostAirdrop Bot.

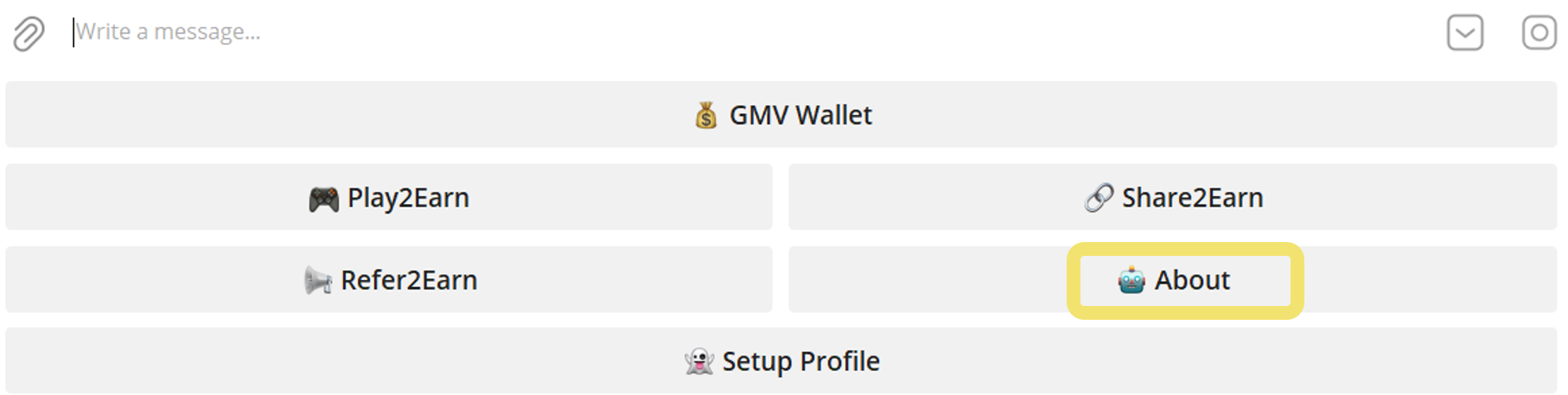

Step 2

Press About

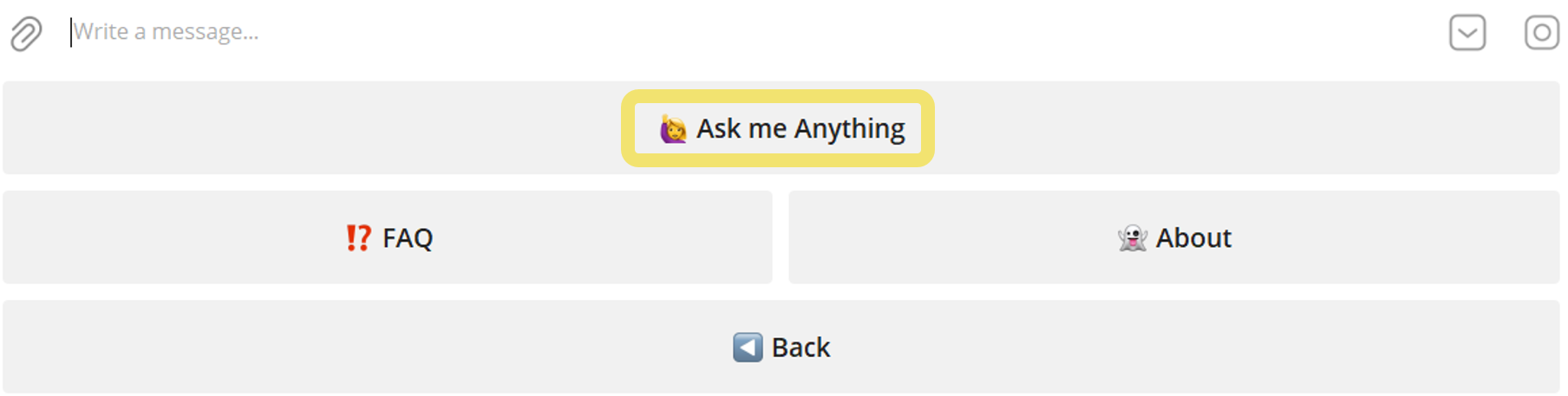

Step 3

Press Ask me Anything

Step 4

Submit your answers