Introduction

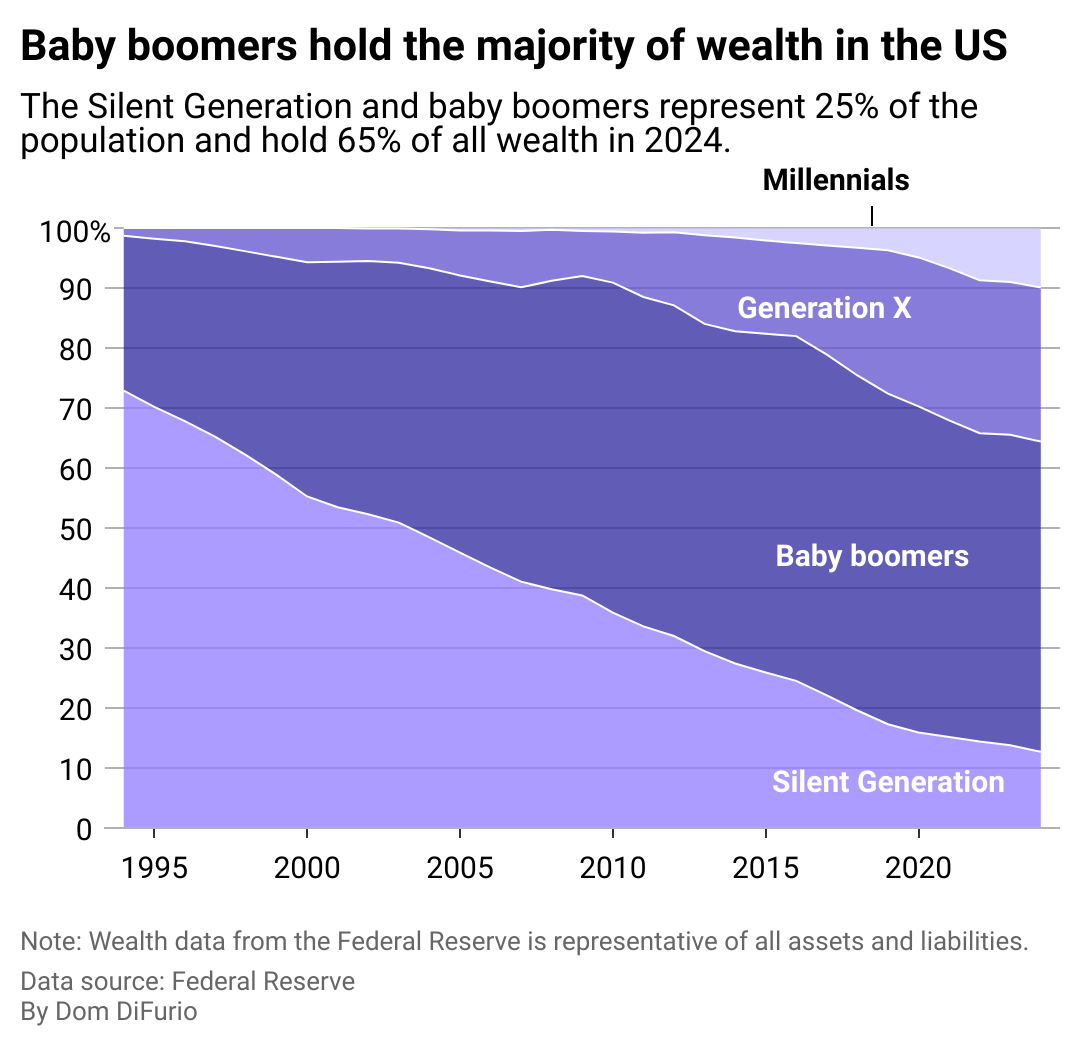

The aging global elites think they will live forever! They will do everything in their power to prevent the natural generational transfer of wealth. With blockchain industry being an emerging wealth transfer vehicle the possibility of a hostile take over of the blockchain industry by the aging web 2.5 legacy institutions is a real threat and WE need to deal with it.

For at least the last 3 years we’ve seen governments, corporations, institutional investors, and retail investors take a keen interest in our industry. But instead of looking through the lens of privacy, anonymity and sovereignty they are looking at it through a lens of control, greed, and enslavement.

This recent pump and dump organized the the Blackrock-US government cabal is the perfect example. There is countless evidence of market manipulation. Trump’s China tariff announcement and a series of trades placed MINUTES before.

TRUMP SON 🚨 : An interesting point about this whale is that they say exactly 1 minute before Trump published the news of a 100% tariff on China on his TRUTH page, he opened a short position with a volume of 1.1 billion dollars on Bitcoin and Ethereum. pic.twitter.com/fHlviNKDQw

— CryptoSkullSignal (@SkullSignal) October 13, 2025

A Toxic, Over-Leveraged Market

In short, the crypto market is HEAVILY over leveraged. Its over leveraged because Blackrock and Microstrategy are playing a game of chicken to see who gives up first. One party buys BTC driving up the price of BTC waiting for the other party to do the same.

Blackrock buying up 45,000 BTC.

MicroStrategy Holdings over time with recent significant increases.

To add insult to injury retails investors are using leverage to buy a TON of crypto using very little fundamental volume. The end result is highly toxic and speculative web2.5 pump and dump cycle the likes of which Charles Ponzi could only dream of.

Will anybody go to jail? They never do!

Degens are the victims:

Two years of profit were wiped out in a noon dumppic.twitter.com/d9Pbj3Cwvi

— naiive (@naiivememe) October 11, 2025

Dude completely wiped out his savings at 36 years old. pic.twitter.com/SKFTdEShIK

— Zoomer 🧢 (@zoomyzoomm) October 12, 2025

The natural response of any sympathetic human being is to blame the system. Let’s reform the existing it. Let’s make the crypto exchanges even more transparent than they already are. Blah, blah, blah…

Cosmos has another point of view. Cosmos blames the victims! As an industry we’ve been through at least 10 massive pump and dump cycles. Here is a post from a few years ago tracking Pump and Dump cycles.

Every, single, time the crypto exchanges mysteriously stop working! The stop losses and market orders places do not execute last second. CZ apologizes. NO ONE gets their money back and few poor schumcks throw themselves of the roof, life goes on!

Ukrainian crypto trader Kostya Kudo, who killed himself, lost about $30M in the market crash.

All investor funds he managed were effectively wiped out, along with his personal holdings.He also left behind a lavish car collection: a 2020 Lambo Urus, and a 2023 Ferrari 296 GTB. https://t.co/C1HaKVrxAY pic.twitter.com/SgNlg4WjIV

— blingsabato (@blingsabato) October 11, 2025

How does this benefit our industry? IT DOES NOT! This toxic speculative cycle does absolutely NOTHING to create a crypto-based circular economy. In fact, it acts as a distraction. Cycles like this attract even more attention from the regulatory bodies who introduce even more “regulatory clarity” – aka barriers that raise the threshold for entry. These barriers are monopolistic by nature, with government being the biggest monopoly on the market. These barriers lower competition to the few approved key players and stifle progress.

The recent example is the GENIUS Act of 2025.

It basically says that only banks and firms with a government issued licenses can issue stablecoins. What about an independent 2 man blockchain dev shop (1 dev, and 1 sales guy)? They can no longer compete in the stablecoin industry. They are out, XRP, Ripple, and CIA infested banks are in!

Great pure web3 projects like Monero are suffering. The Monero Market recently closed:

— Monero Market (@monero_market) April 30, 2025

The Solution: Stop Playing Their Game

This is a public service announcement to the speculative “investors” who dream of 10Xing their $100: STOP BEING A MARK.

The rush you feel from a successful trade is the Hot Hand Fallacy in action—the mistaken belief that recent success increases your chance of further success. You are not a genius; you are a victim playing on infrastructure that is rigged against you.

By using leverage and participating in these Web2.5 crypto exchanges, you are simply providing the necessary liquidity for the elites to consolidate their power. Ultimately, they will take your speculative gains, decrease your purchasing power, and devalue the little savings you do have through inflation.

The only winning move is NOT to play their game.

Build the Crypto Standard

The path to securing a generational transfer of wealth and achieving true sovereignty is not through gambling. It is through fundamental, conscious action:

Shift Your Lens: Stop viewing crypto as a trading asset and start seeing it as an alternative monetary system.

Embrace the Circular Economy: Actively participate in the crypto circular economy. Start running nodes, buying goods and services with crypto, and demanding payment in crypto for your services.

Join Pure Web3 Communities: Seek out genuinely decentralized projects and communities that prioritize the original ethos of blockchain: privacy, sovereignty, and decentralization such as GHOST Whales

The fight is not to reform the dollar but to phase it out. The only way to ensure the generational transfer of wealth is by consciously and actively replacing the Dollar Standard with the Crypto Standard.