Can the fundamental monetary property shortcomings of Vita, detailed in the previous analysis, be resolved? This question is critical, given that Vita’s core advantages – its inelastic supply and inherent capacity for self-replication – remain profoundly significant.

The emergence of a pure Web3.0 ecosystem presents a viable solution to revitalize Vita (no pun intended). When implemented on Web3 infrastructure, all forms of money (fiat, reserve, and Vita) stand to see significant improvements in their functionality. But what is the underlying reason for this universal enhancement?

Web3 Vita Money Properties

The transition to a Web3.0 framework effectively resolves many of the historical limitations associated with key monetary properties – such as portability, indestructibility, homogeneity, divisibility, and cognizability – irrespective of the underlying asset type. While Jevons originally outlined seven essential material properties, the digital realm introduces new qualities worthy of consideration, which will be explored in future installments.

For the purpose of this analysis, however, we will focus on the traditional seven properties recognized by economists. Our objective is to examine how Vita, when implemented on-chain, could potentially surpass both fiat and reserve currencies across these established metrics.

Definitions for these seven properties have been provided in previous articles and can be referenced for clarity.

Utility and Value

As established previously, utility and value constitute the most critical property of money. Sound money must possess inherent worth and practical use that extends beyond its function as a medium of exchange.

In the physical world, this concept is intuitively grasped. Gold, for instance, holds value in jewelry, electronics, and various industries, independent of its monetary role. This tangible utility forms the basis of a common critique from crypto-skeptics, who argue that while gold has industrial and decorative applications, cryptocurrencies like Bitcoin lack such inherent “real-world” uses.

Web3 fiat stablecoins, for example, derive their utility and value almost entirely from their peg to traditional off-chain currencies like the US dollar. Consequently, their standalone utility beyond serving as a digital representation of fiat is limited.

To properly evaluate Bitcoin, one must distinguish between the Bitcoin coin (BTC) and the Bitcoin blockchain. The blockchain itself has clear utility: it functions as a censorship-resistant transaction layer, a decentralized settlement network validated by thousands of independent nodes, and a tamper-proof public ledger. These features provide undeniable functional value.

But what utility does the Bitcoin coin possess? Here, it is instructive to return to Jevons, who noted that utility need not be purely physical or industrial. Metaphysical and social needs – such as adornment, ornamentation, or symbolic value – can also endow an object with monetary utility. He observed:

“Thus the singular peag currency, or wampumpeag, which was found in circulation among the North American Indians by the early explorers, was esteemed for the purpose of adornment, as already mentioned. The cowry shells, so widely used as a small currency in the East, are valued for ornamental purposes on the West Coast of Africa, and were in all probability employed as ornaments before they were employed as money.”

The key insight is that value arises from demand, which itself stems from subjective valuation. As long as Bitcoin is demanded – whether as a store of value, a speculative asset, or a belief system – it holds value, especially bolstered by its inelastic supply.

Fundamentally, Bitcoin’s value can be interpreted as embodied energy – a representation of the electricity consumed during its creation. Since energy expenditure constitutes a major variable cost in mining, it effectively establishes a probable lower bound for Bitcoin’s value. miners are unlikely to sell Bitcoin below the cost of production, as doing so would render operations unprofitable. Fluctuations in network hashrate do not fundamentally alter this principle; rather, they recalibrate the underlying cost structure. A lower hashrate reduces mining expenses, while a higher hashrate reflects greater investment in hardware, infrastructure, labor, and ancillary services, therefully elevating the intrinsic cost basis of each Bitcoin.

As the network grows, Bitcoin evolves from a simple energy-backed asset into one that encapsulates a broader spectrum of economic inputs, such as equipment, human resources, and operational overhead, effectively mirroring a microcosm of real productive effort. This cost-based foundation provides a tangible value floor, irrespective of short-term hashrate volatility.

This interplay between cost, value, and utility echoes a recurring question in regulatory discourse: whether an asset should be classified as a security or a utility token. Bitcoin’s value arises not from cash flows or legal claims, but from its utility as a censorship-resistant, decentralized asset with a predictable monetary policy. This utility sustains demand and reinforces its valuation over time.

Ultimately, the value of money has always been a social agreement built upon real or perceived utility. In the context of Web3, Vita money backed by inherent utility, verifiable scarcity, and productive cost would be exceptionally powerful, especially when enhanced by on-chain functionality and decentralized consensus.

Portability

Web3 fundamentally solves the portability problem inherent in physical money. Digital coins and tokens can be transferred instantly and globally using only a wallet and an internet connection. A user’s entire wealth can be secured through a secret key stored on a piece of paper, a USB drive, or a mobile device, making it possible to transport and manage value with unprecedented ease.

However, portability faces challenges in a multi-chain ecosystem. For native assets like Bitcoin, the lack of innate cross-chain functionality can limit their movement. If a recipient operates on a different blockchain, a transaction cannot be completed directly unless it is routed through a centralized exchange (CEX). This reintroduces traditional barriers such as KYC requirements, the risk of frozen funds, or the potential collapse of the intermediary platform.

Similarly, token-based assets encounter the same hurdle: without secure, decentralized cross-chain bridges, transactions are confined to a single blockchain. To move across chains, users must often rely on centralized bridges or CEXs, which are vulnerable to exploits, hacks, and administrative freezes.

The issue is particularly acute for fiat-backed stablecoins like USDT, USDC, or USDL. These assets are subject to the control of their issuers, who retain the authority to freeze funds at their discretion. As explicitly stated in the terms of USDL:

“WE MAY FREEZE, TEMPORARILY OR PERMANENTLY, YOUR USE OF, AND ACCESS TO, USDL OR THE US DOLLARS BACKING YOUR USDL, WITH OR WITHOUT ADVANCE NOTICE.”

This centralized oversight directly undermines the core principle of monetary portability.

Therefore, for a digital Vita money to achieve true portability, its design must adhere to pure Web3 principles. It must operate on permissionless, interoperable networks that enable cross-chain movement without reliance on centralized intermediaries or the risk of arbitrary restriction. Only then can portability be considered fully realized in the digital realm.

Indestructibility

In the Web3 environment, digital assets exhibit a unique form of durability. Tokens can be intentionally destroyed – or “burned” – by sending them to an unspendable address (e.g., 0x000…000). Barring such an action, coins and tokens persist permanently on the blockchain ledger.

Loss of access to a wallet – for example, through misplacement of private keys – does not equate to the destruction of the assets. The tokens remain recorded on the blockchain, immutable and unspent, though effectively inaccessible to the rightful owner.

Under normal conditions, digital assets are virtually indestructible. However, extreme threats exist, such as a 51% attack on a blockchain network, which could potentially rewrite transaction histories and alter balances. In such scenarios, the very integrity of the ledger is at risk. Yet, the incentive to execute such an attack is often mitigated by game theory: compromising the network could destroy its value, rendering the attack fruitless. Furthermore, decentralized communities can respond by executing a chain fork, restoring the ledger to a pre-attack state and effectively preserving asset durability.

A more practical threat to durability arises with centralized stablecoins like USDT, USDC, or USDL. Their issuers retain the authority to freeze wallets and assets, immediately revoking a user’s access. While the token data may remain on the blockchain, the loss of usability mimics functional destruction for the affected holder.

Therefore, for Web3 Vita money to fulfill the property of durability, it must be built on truly permissionless and censorship-resistant foundations. It should be immune to third-party freezes, irreversible in its transactional finality, and resilient against network-level attacks – ensuring that value, once created, remains accessible and intact under all but the most extreme circumstances.

Homogeneity

Web3 fundamentally ensures homogeneity within any given token standard. Each token issued under the same smart contract is perfectly identical and interchangeable with any other token of that type. This is enforced at the protocol level: the code governing each token is identical, meaning that one unit of a specific digital asset is always equal in value and functionality to every other unit.

For Vita money implemented on-chain, this inherent feature of blockchain technology completely resolves the issue of homogeneity. Unlike physical commodities – where individual units can vary in quality, size, or features – every token representing Vita would be uniform. Whether used in transactions, as collateral, or for storage of value, each unit is certifiably equal, eliminating any need for verification of individual quality or authenticity.

Divisibility

Web3 fundamentally resolves the historical challenge of divisibility. Digital tokens can be subdivided with a degree of precision far exceeding that of physical assets. Depending on the token specifications, it can typically be divided into units as small as 9 to 18 decimal places. Though some, like USDT, use a more limited 6-decimal format.

This means that even the smallest fractions of value can be transacted, enabling micro-payments and precise financial interactions that are impractical with traditional or commodity-based money. For Vita money implemented on a blockchain, the issue of divisibility is completely eliminated. The underlying protocol allows any amount of value to be divided, combined, or transferred without loss, ensuring that the asset remains functional as a medium of exchange at any scale.

Stability of Value

Web3 Vita demonstrates a fundamentally different value proposition compared to both digital fiat and reserve assets. While digitized fiat currencies inherently carry the inflationary nature of their physical counterparts, and tokenized gold primarily serves as a stable store of value, Vita introduces a dynamic mechanism for value preservation and growth through its self-replicating property.

Through its inherent capacity for self-replication, Vita not only retains value but possesses the ability to expand it. This characteristic allows it to function not merely as a stable store of wealth, but as an asset with a highly defensive profile. Unlike static reserve assets that maintain value through scarcity alone, Vita’s value grows organically through its innate reproductive mechanism, creating a dynamic where holders can benefit from both scarcity and expansion simultaneously.

Such combination of inelastic supply and self-replicating capability positions Web3 Vita as a superior store of value, one that could potentially outperform both fiat-based and reserve digital assets in long-term value preservation and growth.

Cognizability

Web3 fundamentally transforms cognizability as it becomes easy for money to be recognized and authenticated. In digital form, verifying the authenticity of a coin or token becomes a matter of validating its underlying code. Each asset is defined by a smart contract or protocol, and its legitimacy can be instantly confirmed by checking that its properties match those of the genuine token standard. This eliminates the risk of counterfeiting, a persistent challenge in physical monetary systems.

Whether representing fiat, reserve assets, or Vita, every on-chain token benefits from this inherent transparency and verifiability. For Vita money, this means that its authenticity can be effortlessly confirmed by any participant in the network, ensuring trust and eliminating the need for intermediaries or specialized equipment to validate its legitimacy.

Money Score

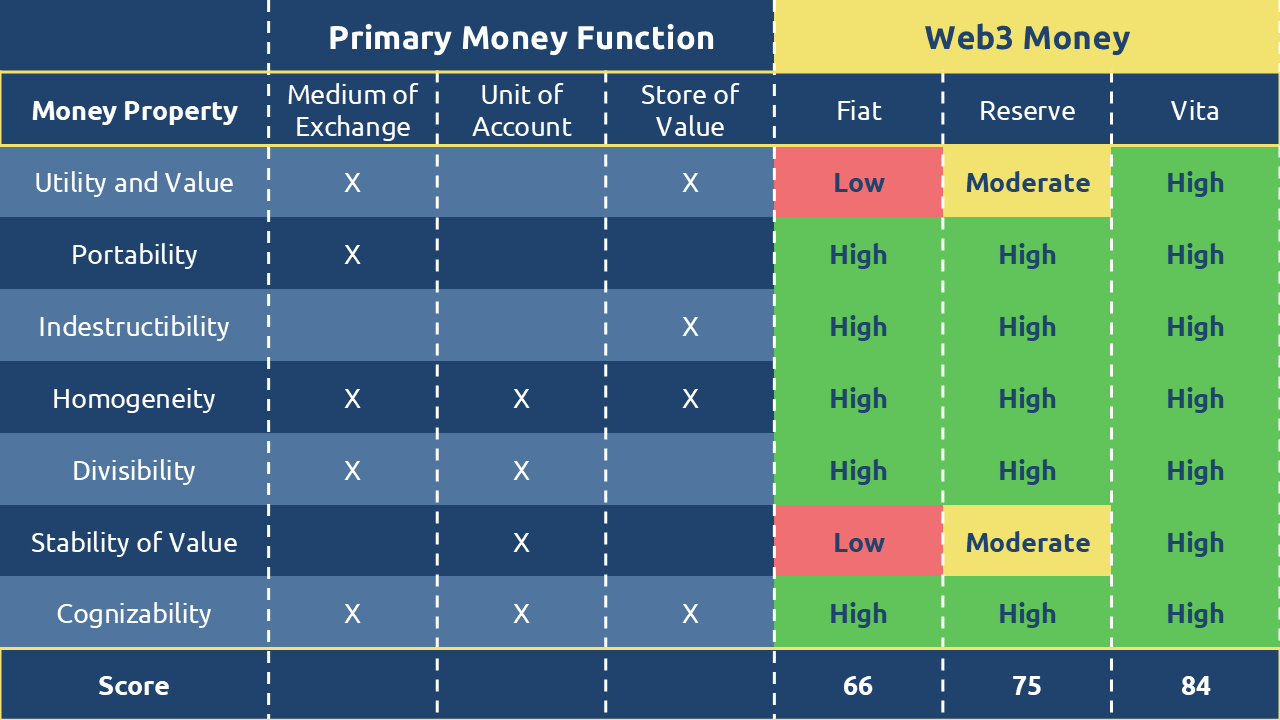

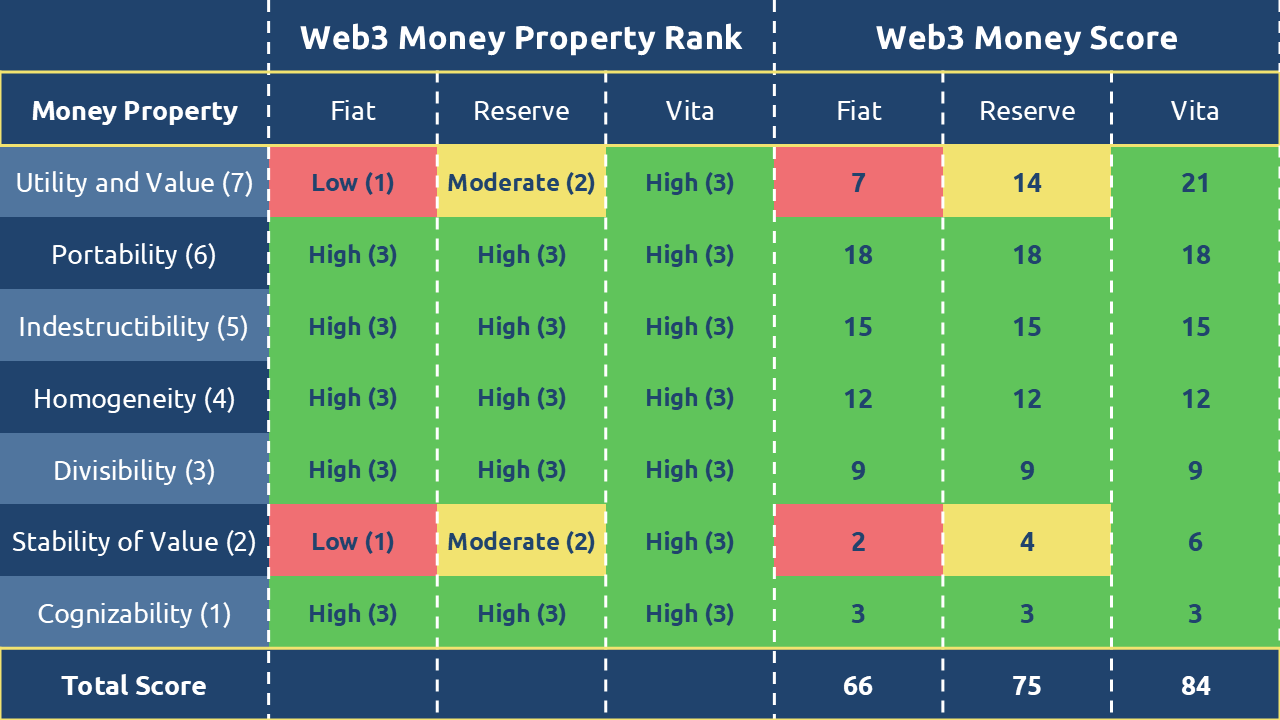

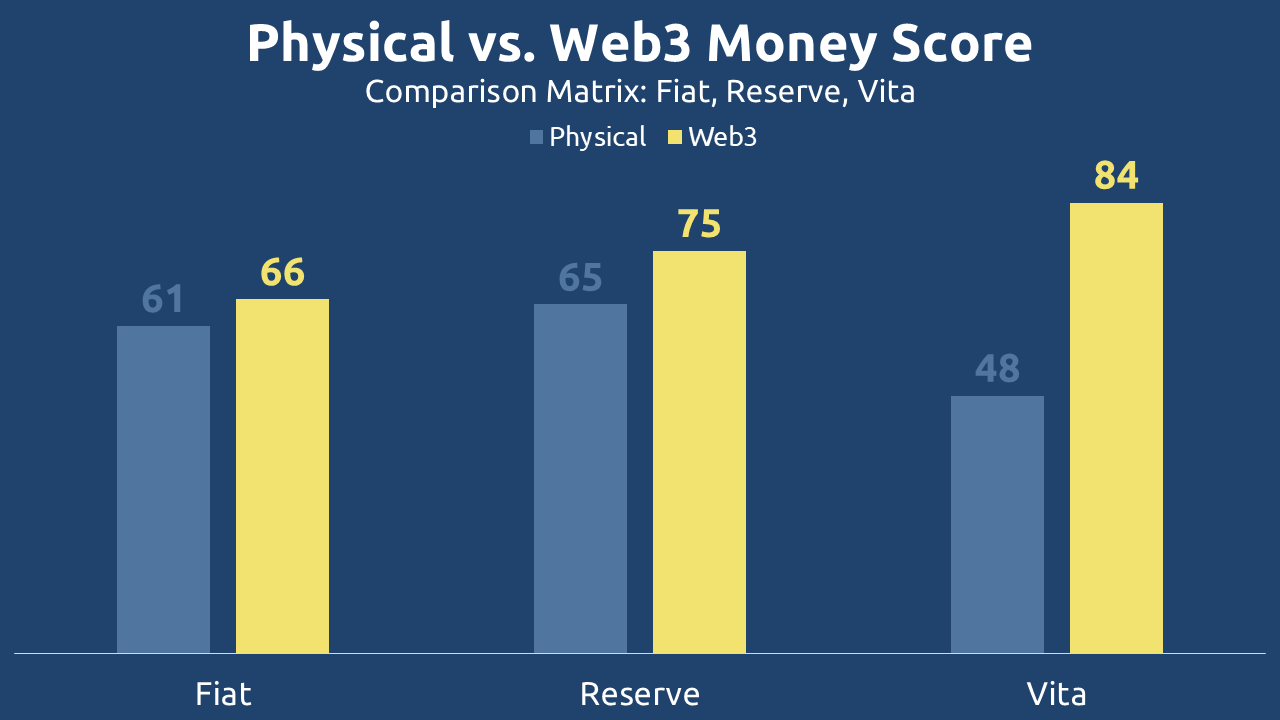

Employing Jevons’ weighted hierarchy of monetary properties – where essential qualities like utility and value receive the highest weighting, while secondary features such as cognizability carry less weight – each category of Web3 money was assessed on a performance scale of 1 (low satisfaction) to 3 (highly satisfactory). The aggregate scores, detailed in Figure 2, demonstrate a definitive ranking:

- Web3 Vita Money emerged superior with a score of 84

- Web3 Reserve Money followed with a score of 75

- Web3 Fiat Money trailed with a score of 66

This outcome highlights a crucial finding: Vita money undergoes the most substantial transformation when transitioned to Web3. The decentralized digital environment resolves the historical vulnerabilities (such as divisibility, durability, and portability) that hindered its physical predecessors. Through blockchain architecture, Vita evolves from a theoretically ideal but practically limited money form into a fully functional, operationally superior asset.

Where physical constraints once made Vita impractical, Web3 infrastructure now makes it not only viable but exceptional. Vita fulfils its promise as money that preserves and grows value through inherent properties rather than institutional backing.

Vita Limitations Overcome by Web3

The historical limitations of Vita money can be effectively addressed through Web3 architecture. By transitioning to decentralized digital infrastructure, Vita reclaims its potential as a viable modern monetary instrument.

Maintenance

While Web3 Vita does not eliminate maintenance entirely, it significantly reduces the burdens associated with its physical counterpart. Managing digital Vita requires:

- Securely storing private keys

- Maintaining relevant blockchain nodes

- Staying informed about technical upgrades

- Understanding tokenomics mechanisms

However, these requirements are substantially more manageable than the physical upkeep of agricultural or livestock-based Vita. Web3 Vita demands digital literacy rather than geographical presence, agricultural expertise, or physical storage solutions. This shift from physical to digital maintenance represents a fundamental improvement in accessibility and practicality, making Vita ownership and management feasible for a global population without requiring specialized agricultural knowledge or resources.

Finality of Settlement

The historical challenges surrounding final settlement that plagued physical Vita money – from early tribal exchanges to more sophisticated systems like the colonial tobacco standard – are fundamentally resolved through blockchain technology. Web3 introduces an immutable, consensus-based settlement layer that ensures transactional finality in ways previously unimaginable.

Unlike physical settlement systems that relied on social trust, institutional enforcement, or cumbersome warehouse receipt systems, blockchain-based settlement provides mathematical certainty. Transactions achieve finality through decentralized consensus rather than third-party verification, creating a system where value transfer becomes as irreversible as it is transparent.

Universal Availability

While no technological system – including the internet itself – can claim perfect universality, Web3 architecture substantially enhances the global accessibility of Vita money compared to its physical predecessors. The inherent standardization of blockchain-based systems, operating through unified protocols and decentralized applications, creates a fundamentally more accessible framework for value exchange than geographically constrained physical commodities.

The critical factor in maximizing availability will be maintaining genuinely permissionless access mechanisms. By minimizing entry barriers – whether technical, financial, or regulatory – Web3 Vita can achieve significantly broader inclusion than physical Vita ever could. This represents a fundamental shift from location-dependent value storage to globally accessible digital value representation, though it remains contingent on internet accessibility and basic technological infrastructure.

Network Effect

While conventional wisdom suggests cryptocurrency leadership has already been established – with Bitcoin commanding a $2.2 trillion market capitalization as of August 25, 2025, representing 58% of the entire crypto market – this analysis reveals a more nuanced reality. Bitcoin essentially replicates the monetary characteristics of a reserve asset rather than introducing a fundamentally new paradigm.

Yet even Bitcoin’s substantial valuation remains modest compared to physical gold’s approximately $23 trillion market value, indicating significant potential growth for digital reserve assets. More importantly, physical Vita assets already represent an even larger market capitalization than physical gold, though this will be explored later in this series.

The competition for dominant Web3 money remains in its early stages. While Bitcoin currently deserves its position as market leader, Web3 Vita represents an evolutionary step in money itself; one that could potentially reshape the entire cryptocurrency landscape by offering something neither fiat nor pure reserve assets can provide.

Vita Advantage

Vita’s reproductive capability transforms the value accumulation proposition. Unlike reserve assets where ownership remains static (one ounce of gold today remains one ounce tomorrow), Vita generates what might be termed Vita Dividends – additional units created through its inherent self-replicating mechanism.

How do Vita’s unique properties contribute to its potential for widespread adoption?

All value storage comes with acquisition challenges. While reserve assets like gold and Bitcoin maintain constant nominal quantities – one ounce remains one ounce, one Bitcoin remains one Bitcoin – most people earn in depreciating fiat currencies. This creates the persistent dilemma of how to effectively convert weakening fiat into sustainable reserve assets.

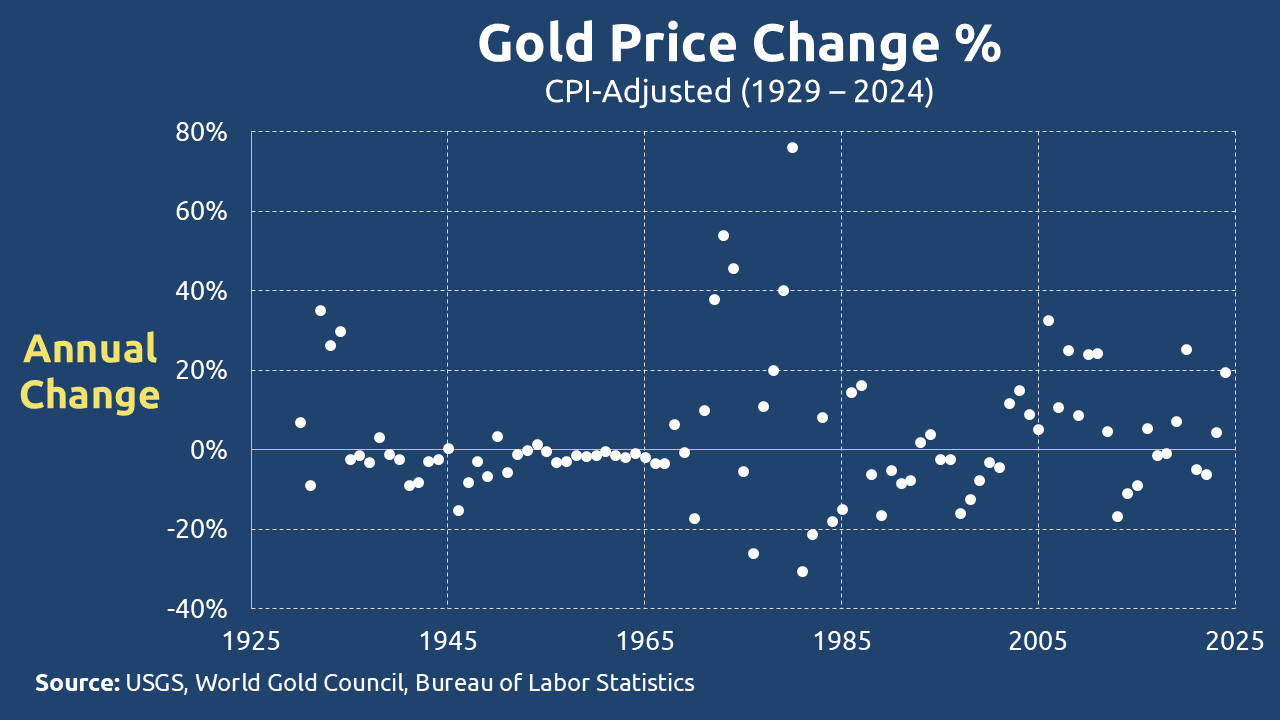

Even gold, among the most stable reserve assets, exhibits substantial price volatility with approximately 17% annual standard deviation. Setting aside practical considerations about physical versus digital gold exposure and storage complications, investors face the fundamental timing question: when to convert fiat into gold? Should one attempt to time the market, assess whether current prices represent overvaluation, or simply employ dollar-cost averaging through regular monthly purchases? This timing uncertainty represents a significant barrier to effective wealth preservation for ordinary investors.

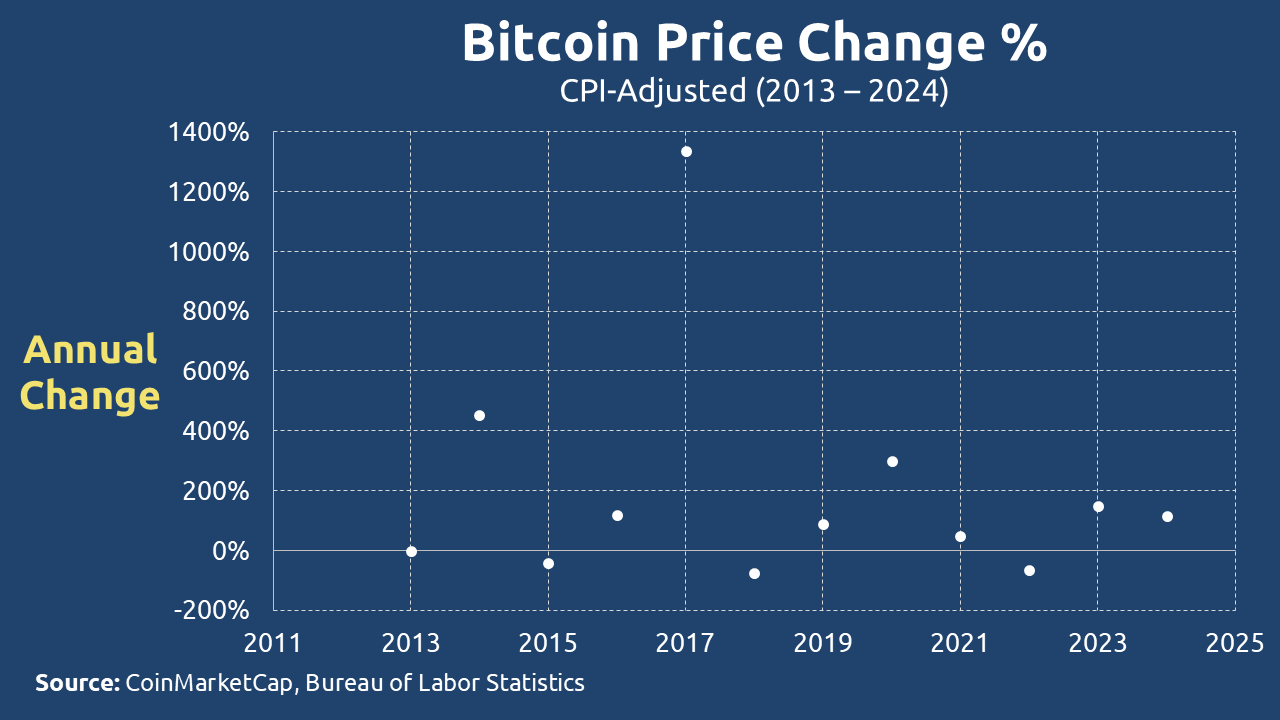

This timing dilemma becomes even more pronounced with Bitcoin. As of August 25, 2025, with BTC trading between $110,000 and $120,000, investors face a classic valuation paradox: future observers from 2035 might consider this price range remarkably low, while current participants perceive it as potentially elevated. This creates the essential investment dilemma – whether to purchase immediately, await a potential price correction, or employ dollar-cost averaging to mitigate timing risk.

Vita introduces an entirely different value proposition through its self-replicating capability. The Vita Dividend creates a dual-component valuation model where investors consider both price appreciation and quantitative expansion. For instance, if Vita were overvalued by 20% but offered a 25% expansion yield, the combined effect would neutralize the initial overvaluation:

In the aforementioned example:

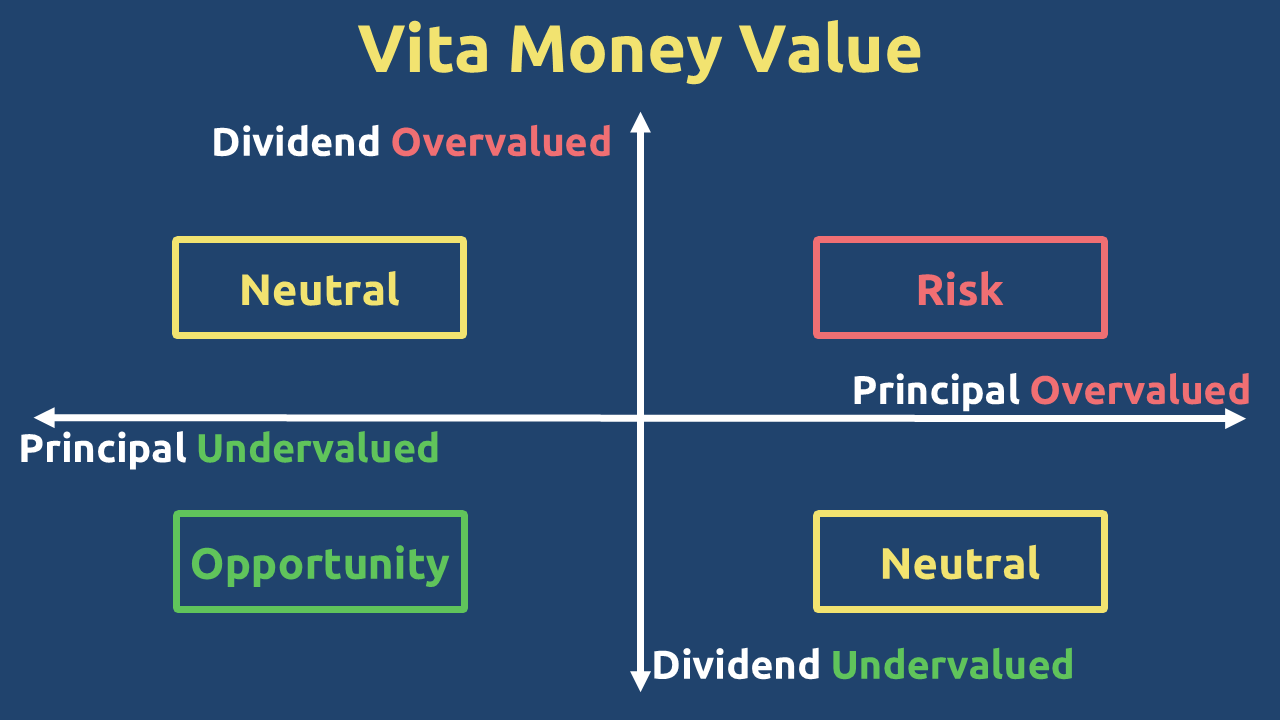

This capacity to offset pricing risk through organic growth stands in stark contrast to static reserve assets. While Vita could certainly experience periods where both price and expansion rates are overvalued, this dual-variable system actually creates more potential positive scenarios than conventional assets. As illustrated in Figure 6, three of the four possible combinations of price and expansion movements produce potentially favorable entry points.

This structural advantage – the ability to maneuver between principal and dividend – explains why Vita assets historically dominated global wealth preservation strategies and suggests why their Web3 implementation could fundamentally reshape how we think about storing value in the digital age.

The Fundamental Properties of Web3 Vita

Beyond its two core monetary properties – inelasticity and self-replicability – Web3 Vita requires a third essential quality: it must be built on a genuine Web3 architecture.

These three properties form the complete foundation of Web3 Vita:

- Inelasticity

- Self-replication

- Web3 architecture

While the first two properties have been thoroughly examined in the previous analysis, the third – Web3 architecture – warrants deeper exploration.

This naturally leads us to a crucial question: what exactly does it mean for a project to possess a true Web3 architecture?