We now examine the core tokenomics of eGHST to understand its fundamental monetary properties. This analysis provides foundational insights that will be expanded in subsequent publications.

The eGHST token serves as the economic backbone of ghostDAO, fulfilling two critical functions:

- Price Discovery Mechanism: Facilitated through decentralized exchange (DEX) liquidity pools

- Cross-Chain Liquidity Nucleus: Acting as the bridge asset for multi-chain operations

Single-Chain Elasticity

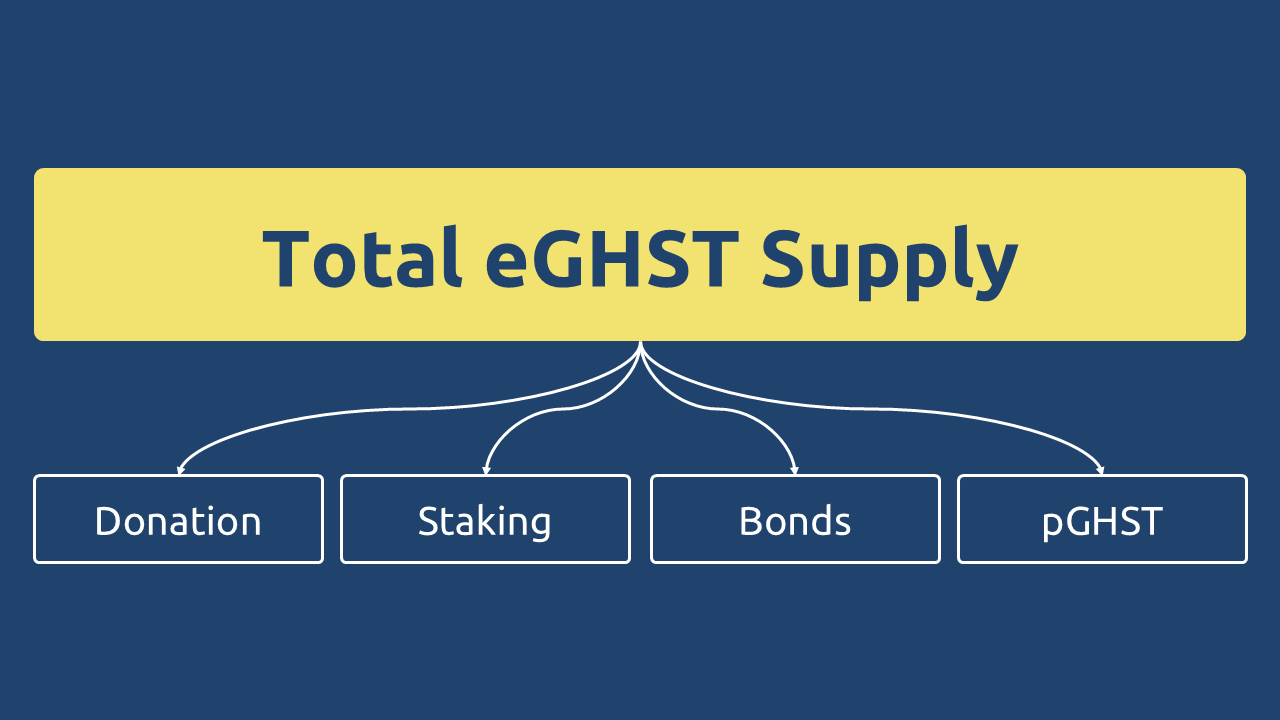

The complete supply composition of eGHST on a single chain follows this precise formulation:

Where each component represents:

- Initial(eGHST): Genesis supply created at ghostDAO launch

- Staking(eGHST): Tokens minted as staking rewards

- Total(Bonds): Debt instruments issued against protocol assets

- Total(pGHST): Conditional airdrop claims

The equation reveals eGHST’s elasticity model – while the initial supply remains fixed, other components can expand or contract based on:

- Staking participation rates

- Bond market activity

- Cross-chain bridging demand

Let’s subsequently analyze how these variables interact to determine eGHST’s effective supply elasticity.

Initial Donation

The Initial(eGHST) represents the genesis token creation necessary to establish the primary eGHST-DAI liquidity pool. This initial supply is minted exclusively by the SuperMinter contract drawing directly from protocol Treasury reserves, with a strict requirement: minting only occurs when an equivalent dollar amount of DAI is deposited into the Treasury. This 1:1 collateralization ensures every eGHST in existence maintains a hard price floor of $1.

The minted eGHST, combined with its matching DAI amount, forms the foundational liquidity pool on the DEX. Crucially, 100% of the resulting LP tokens are permanently allocated to the ghostDAO Treasury, achieving two simultaneous objectives:

- Establishing an immutable $1 price guarantee through full collateralization

- Ensuring complete protocol ownership of the core liquidity position (Protocol-Owned Liquidity or POL) and its associated trading fees

This dual-phase initialization (token minting + liquidity donation) serves as a one-time protocol bootstrap event. The Initial(eGHST) supply becomes permanently fixed after this genesis creation, forming the non-inflationary base layer of the token’s monetary architecture. Unlike other supply components that may fluctuate, this initial allocation remains constant throughout protocol operation.

Staking

The Staking(eGHST) component encompasses all tokens allocated to sGHST staking and GHST wrapping operations. This quantity is critically important because it directly interacts with the APY mechanism governed by ghostDAO.

The protocol converts the annual APY into 8-hour rebase periods, applying this yield to three specific eGHST allocations:

- Tokens staked as sGHST

- Wrapped GHST positions

- eGHST provided to DEX liquidity pools

This rebasing mechanism creates an elastic supply characteristic, but with carefully designed constraints. While staking does temporarily expand eGHST supply, this elasticity is bounded by a hard-coded price floor. The system automatically suspends supply expansion when the Risk-Free Value (RFV) reaches $1 per eGHST.

Risk-Free Value (RFV) Definition

RFV represents the total value of Treasury assets (primarily DAI and eGHST-DAI LP tokens, but potentially including other stablecoins and native currencies) divided by the total eGHST supply. This metric serves as the fundamental valuation anchor for the protocol.

Elasticity Scenarios

- Elastic Phase (RFV > $1): Supply expands through rebasing

- Inelastic Phase (RFV = $1): Automatic yield suspension activates

The protocol allows for governance intervention to establish higher price floors (similar to OlympusDAO’s $10 pause in 2023), but maintains the $1 floor as an immutable backstop. The protocol’s design ensures eGHST will inevitably transition to supply inelasticity through one of two pathways:

- Automatic Stabilization: When RFV naturally declines to the $1 threshold, the protocol’s smart contracts will programmatically disable staking rewards, permanently fixing the supply.

- Governance Intervention: DAO members may proactively vote to suspend yield generation at a higher RFV level (e.g., $5-$10 range), similarly locking the supply.

In both outcomes, the elastic expansion phase conclusively terminates, establishing permanent supply inelasticity. The $1 floor serves as the system’s fail-safe, while governance retains optionality to stabilize at more favorable valuations. This dual-path design guarantees eventual monetary stability while preserving flexibility during growth phases.

Bonds

The bond system represents the most complex element in evaluating eGHST’s supply quality, as its mechanics directly influence the token’s monetary properties. Bonds function as a discount mechanism, allowing users to acquire eGHST by exchanging other assets.

The protocol currently supports two bond types:

- DAI Bonds: Purchase eGHST at a discount using DAI

- LP Bonds: Exchange eGHST-DAI LP tokens for discounted eGHST

Each bond operates under three key constraints:

- A maximum capacity limiting the eGHST available per auction

- An initial discount rate set by ghostDAO governance

- A Dutch auction mechanism that gradually increases the discount until reaching the $1 floor

Critically, the protocol enforces a hardcoded restriction preventing any bond purchases below $1 per eGHST. While bond creation doesn’t automatically mint new tokens, any completed purchase does increase circulating supply. This raises important questions about how bonds affect eGHST’s supply elasticity, which we’ll examine through two key scenarios.

RFV = $1 AND Bond Discount = 0%

When the protocol’s risk-free value reaches the $1 threshold, several critical mechanisms activate. As established in the staking analysis, this condition triggers an automatic halt to all eGHST inflation. The bond system enters a constrained state where the $1 price floor makes positive discount bonds mathematically impossible – only neutral (0%) or negative discount bonds can exist under these parameters.

In practice, this typically results in minimal bond participation. Without economic incentives, most users avoid bond purchases, causing eGHST supply to become perfectly inelastic. The fixed supply remains constant regardless of market price fluctuations. Even in the hypothetical scenario where bonds with zero or negative discounts see unexpected demand, the mathematical limit shows that new bond issuance would have diminishing marginal impact on total supply as time progresses:

This convergence occurs because:

- Each new bond’s contribution to total supply becomes progressively smaller

- Price remains pegged to the $1 RFV baseline

- The elasticity equation resolves to an indeterminate form (0/0)

While theoretically indeterminate, real-world behavior under these conditions overwhelmingly favors inelastic outcomes. The protocol’s design ensures that at RFV=$1, supply expansion becomes either economically impractical or mathematically negligible, creating an effective hard cap on circulating eGHST. This emergency stabilization mechanism serves as the system’s ultimate safeguard against inflationary scenarios.

RFV > $1 AND Bond Discount > 0%

When the protocol’s risk-free value (RFV) remains substantially above the $1 threshold with eGHST trading at a premium, ghostDAO governance typically maintains this equilibrium to preserve continuous bond offerings.

DAI Bonds

In this environment, DAI bonds function as a direct Treasury mechanism, allowing users to acquire eGHST at predetermined discounts using DAI stablecoins.

These transactions exhibit unique monetary properties:

- Short-Term Effects: Each DAI bond purchase immediately increases circulating eGHST supply without exerting downward pressure on DEX market prices, creating textbook conditions of perfect short-term elasticity (ΔQ > 0, ΔP = 0).

- Long-Term Convergence: As cumulative bond sales progress, the marginal supply contribution of each new bond diminishes asymptotically toward zero. While the price impact remains perpetually neutral, the dwindling supply influence creates a mathematically indeterminate elasticity state (0/0) in the limit.

This dynamic suggests that while DAI bonds initially behave as pure elastic instruments, their long-term influence trends toward neutral with residual elastic tendencies, as the protocol continues exhibiting non-zero (though decreasing) supply responsiveness to bond activity. The sustained but diminishing supply growth prevents perfect long-term inelasticity despite the price stability.

LP Bonds

LP bonds offer users discounted eGHST in exchange for eGHST-DAI liquidity pool tokens, creating a more complex interaction with market dynamics than simple DAI bonds.

The acquisition process involves three sequential steps that each affect market conditions:

- DAI-to-eGHST Swap: Users first convert DAI to eGHST on the DEX, creating immediate buy pressure that pushes prices upward before any new supply enters circulation.

- Liquidity Pool Formation: The acquired eGHST is then paired with remaining DAI to create new LP tokens, locking up portions of both assets.

- Bond Redemption: These LP tokens are finally exchanged for discounted eGHST from the Treasury, introducing new supply.

The price impact follows the DEX slippage formula:

Where represents the liquidity ratio between swapped and existing DAI in the pool.

Short-Term Effects

The initial swap’s exponential price impact (via the slippage formula) dominates the subsequent supply increase from bond redemption. This creates strong inelastic tendencies as price movements outweigh quantity changes.

Long-Term Behavior

While both price and quantity effects diminish over time:

- The persistent price impact from slippage maintains slight inelastic bias

- Supply changes become negligible at the margin

- The system trends toward mathematical indeterminacy (0/0) but retains fundamental inelastic characteristics

This mechanism demonstrates how LP bonds create fundamentally different elasticity profiles than DAI bonds, with their multi-stage process generating price impacts that persist even as supply effects attenuate. The protocol’s design ensures these bonds cannot produce purely elastic outcomes, instead maintaining structural inelastic tendencies through their operational requirements.

Market Realities

The elasticity impact of bonds on eGHST supply operates on two distinct levels. At the protocol level, short-term effects vary significantly between bond types – DAI bonds create elastic conditions through direct supply expansion, while LP bonds induce inelasticity through their price-impact mechanism. Over longer time horizons, both bond types exhibit converging behavior, trending toward mathematically indeterminate elasticity states as marginal effects diminish.

However, these technical characteristics exist separately from actual market behavior. In practice, bond demand follows fundamental economic incentives rather than abstract elasticity parameters. When investors anticipate price appreciation, bond participation increases despite the potential supply expansion. Conversely, stagnant or bearish conditions suppress bond activity regardless of the protocol’s theoretical elasticity capacity.

This creates an important divergence between design and reality. While the bond system is architecturally capable of both elastic and inelastic outcomes, real-world usage will predominantly favor inelastic conditions. Rational market participants naturally prioritize price growth over supply expansion, making bond demand inherently pro-cyclical. The system’s $1 RFV floor further reinforces this tendency by establishing an absolute backstop against excessive inflation.

pGHST

The pGHST token represents a unique component of GHOST’s monetary architecture. These tokens originate from GMV (Ghost Market Value) assets held within JML collateral positions, undergoing conversion through a precise redemption mechanism:

The conversion formula establishes that:

where

This mechanism exhibits three key properties:

- Fixed Supply Basis: The total pGHST supply is directly pegged to the GMV quantity at mainnet launch, creating an immutable upper bound

- Deterministic Conversion: Each pGHST redemption requires additional DAI collateralization, ensuring the protocol maintains its value backing

- Non-Inflationary Impact: The static pGHST supply prevents any expansionary pressure on total eGHST circulation

These characteristics make pGHST a strictly inelastic component of the system. Unlike bonds or staking mechanisms, pGHST conversions cannot introduce supply variability – they simply facilitate the migration of pre-existing value from the GMV system to the main GHOST economy. The fixed conversion parameters ensure this process occurs without disrupting the protocol’s broader monetary stability.

Summary

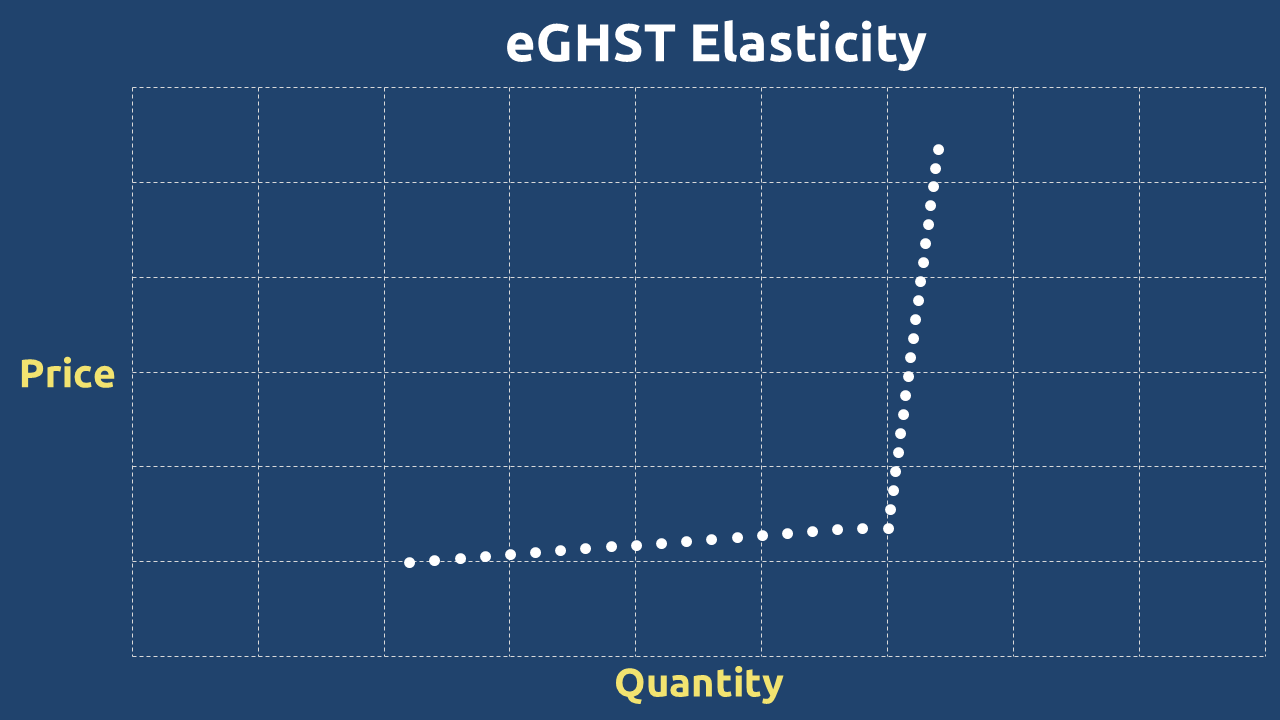

The elasticity profile of eGHST presents a unique monetary architecture that evolves dynamically across different time horizons and constituent components.

| eGHST Constituent | Short-term | Long-term |

| Donation | Perfectly Inelastic | Perfectly Inelastic |

| Staking | Elastic | Inelastic |

| DAI Bonds | Elastic | Neutral |

| LP Bonds | Inelastic | Neutral |

| pGHST | Perfectly Inelastic | Perfectly Inelastic |

| eGHST | Elastic | Inelastic |

When aggregated, these components create eGHST’s distinctive dual-phase elasticity profile:

- Short-term: Net elastic characteristics (dominated by staking and DAI bonds)

- Long-term: Net inelastic properties (as constraints activate)

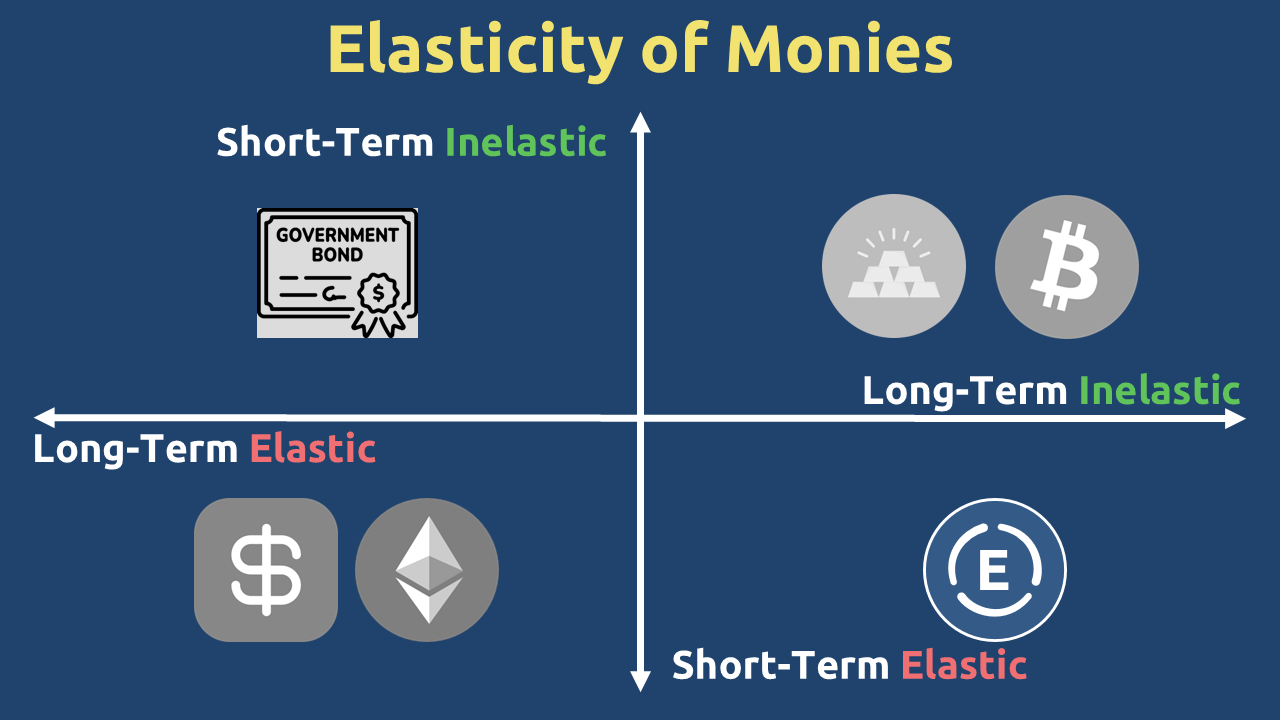

This architecture positions eGHST uniquely in monetary ecosystems (Figure 3). The transition from elastic to inelastic phases creates valuable accumulation opportunities:

- Early elastic phase allows for supply growth and participation incentives

- Eventual inelasticity ensures long-term scarcity preservation

- The RFV floor provides absolute downside protection

This carefully engineered elasticity matrix gives eGHST hybrid characteristics – maintaining short-term flexibility for growth while guaranteeing long-term scarcity, a combination rarely achieved in monetary systems. The predictable phase transition from elastic to inelastic states creates a compelling value proposition for both early participants and long-term holders.

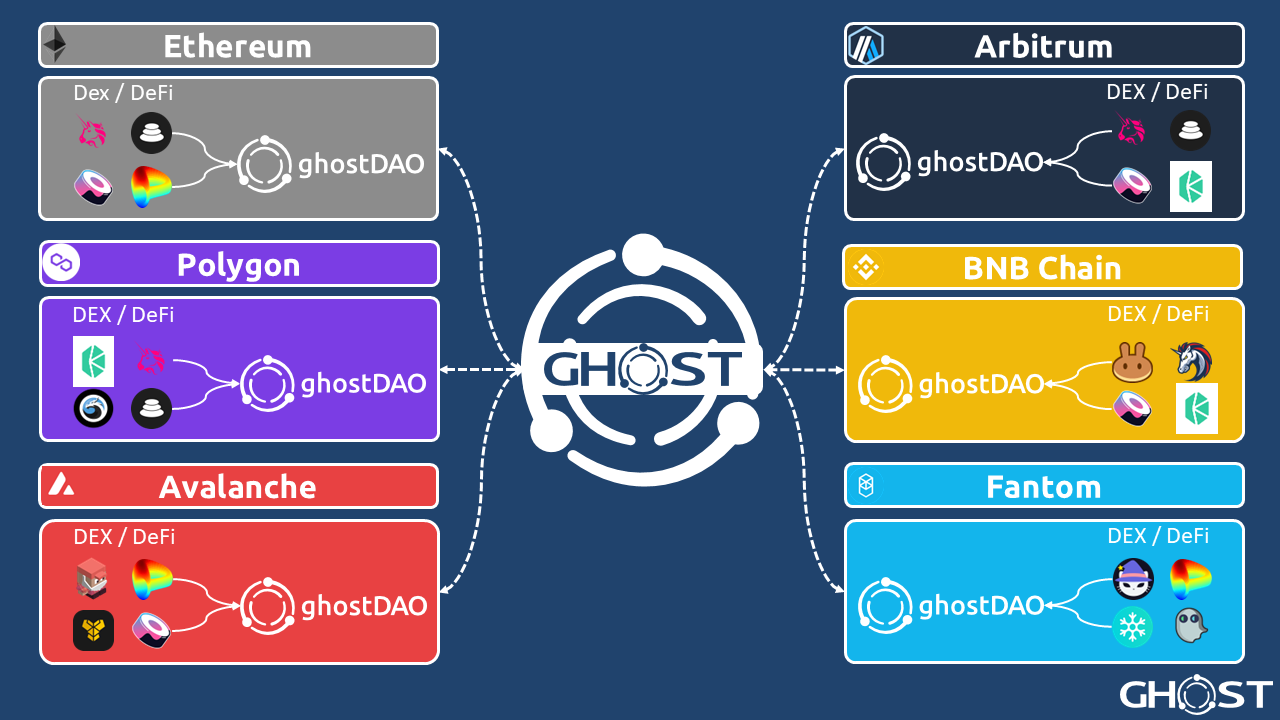

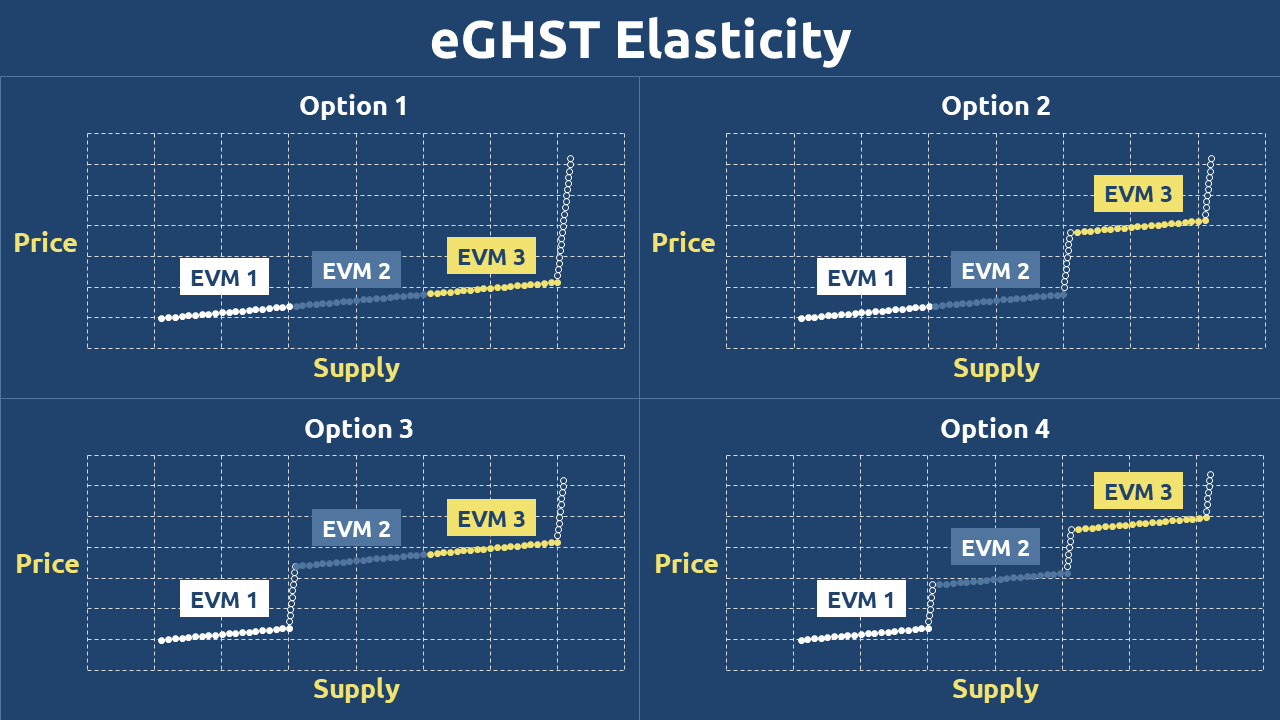

Multi-Chain Elasticity

The expansion of ghostDAO to additional blockchains introduces new dimensions to eGHST’s supply mechanics. Each new chain deployment initiates a fresh cycle of elasticity, beginning with an elastic phase before transitioning toward inelasticity, as the cumulative supply across all chains ultimately determines the true total eGHST.

Cross-chain launches may temporarily extend eGHST’s elastic properties depending on their timing and frequency. However, the long-term trajectory remains fundamentally inelastic. This is because all four core constituents – Donation, Staking, Bonds, and pGHST – inevitably converge toward supply rigidity, regardless of how many chains are added.

While multi-chain expansion could theoretically prolong elasticity (Figure 5), the protocol’s design ensures that each new chain’s contribution to total supply diminishes over time.

Ultimately, even with multiple chains, eGHST maintains its unique monetary transition – elastic growth phases for expansion, followed by inelastic scarcity for long-term value preservation. The multi-chain architecture enhances utility without compromising the protocol’s core stability mechanisms.