The Truth About Deflationary Assets in Crypto

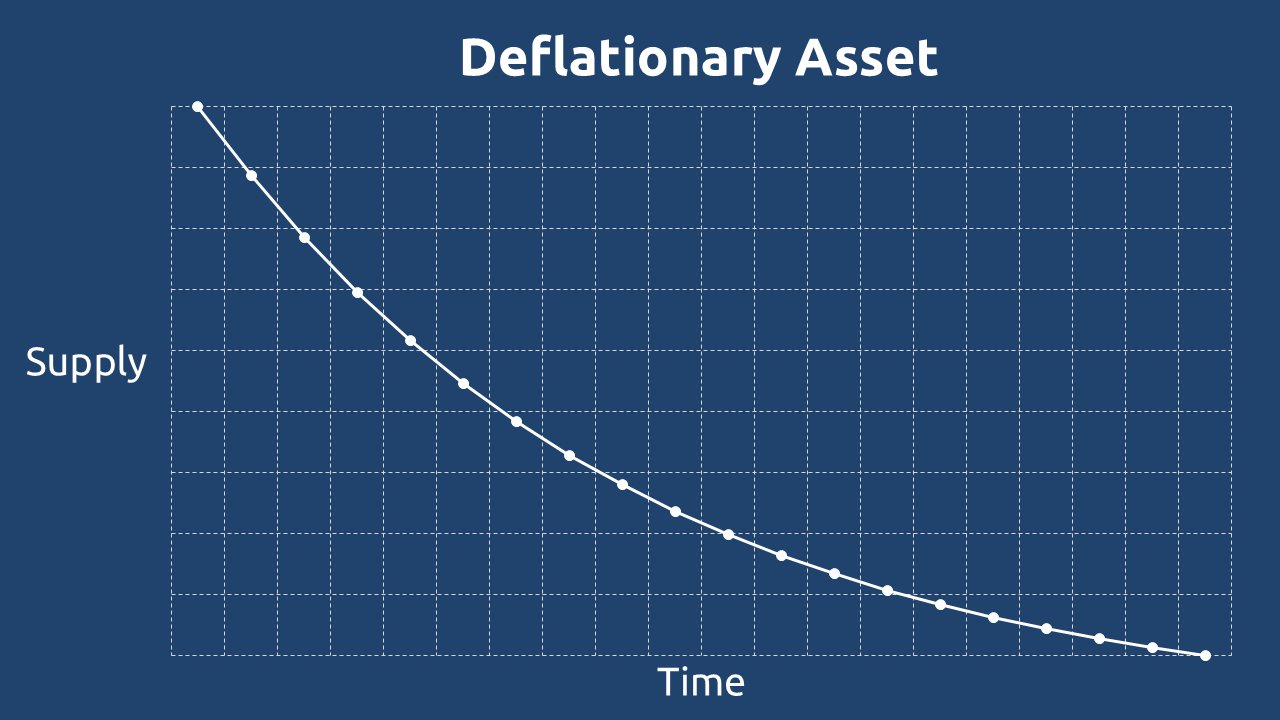

True deflationary assets are defined by one key characteristic: a decreasing total supply over time. While numerous cryptocurrency proponents – including major industry players – assert that Bitcoin qualifies as deflationary, this classification doesn’t withstand scrutiny. Similar claims about gold and other assets equally miss the mark.

This mislabeling isn’t merely semantic; it carries significant implications. By incorrectly branding an asset as deflationary, market participants create a false perception of artificial scarcity, potentially misleading investors about its fundamental value proposition.

Why Bitcoin Doesn’t Qualify as Deflationary

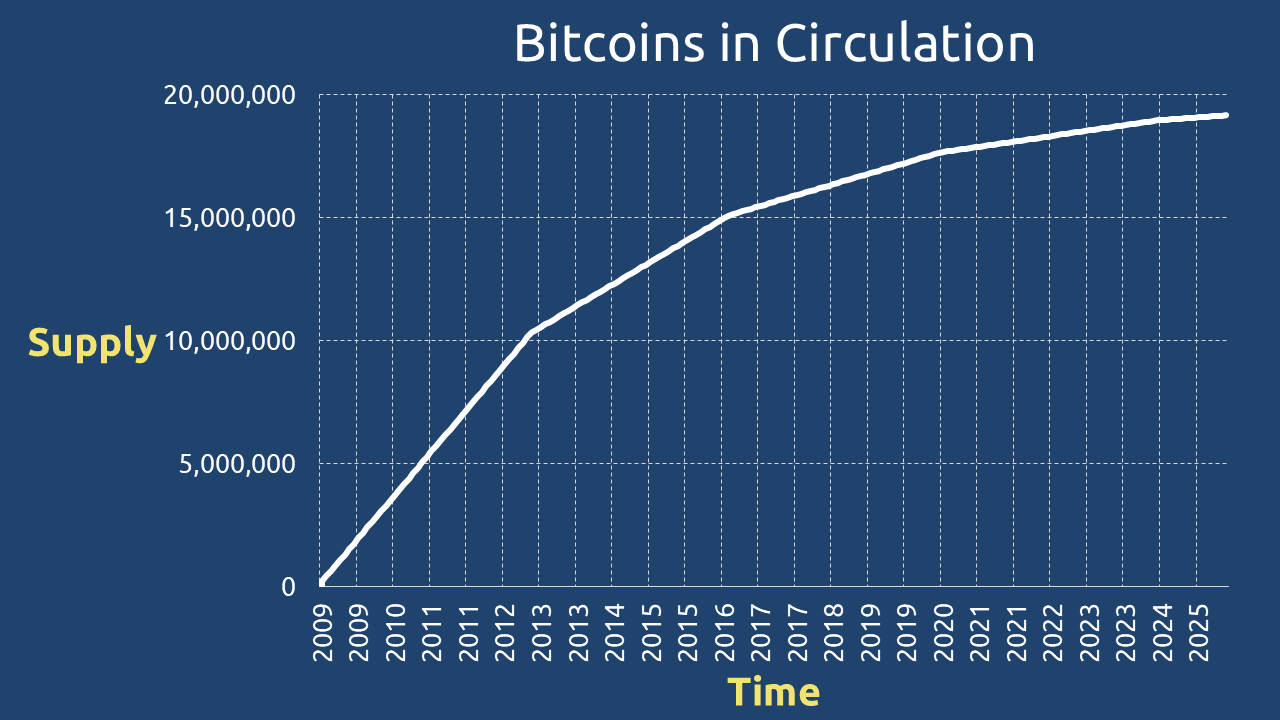

Bitcoin’s monetary policy follows a predetermined issuance schedule that will continue until approximately 2140. While its block reward halvings (occurring every four years) progressively slow new supply, the network continues inflating Bitcoin’s circulating supply until the final coin is mined.

Let’s debunk the “Bitcoin is Deflationary” arguments.

Myth 1. Lost Bitcoin Makes It Deflationary.

- Claim: ~20% of Bitcoin is “lost” (lost keys, dead wallets).

- Reality: These coins still exist on-chain – they’re just inactive. No supply reduction occurs.

Myth 2. Population Growth Outpaces Bitcoin Supply.

- Claim: More people = fewer Bitcoin per capita = deflationary pressure.

- Flaw: This is demand-side speculation, not a supply constraint. Bitcoin’s issuance schedule remains inflationary until 2140.

Myth 3. Post-2140, Bitcoin Becomes Deflationary.

- Claim: Once all Bitcoins are mined, supply stops growing.

- Reality: Constant supply ≠ deflationary. Deflation requires active reduction(e.g., burning).

Critical Distinction:

Bitcoin is best classified as disinflationary – its inflation rate decreases over time – but it won’t become truly deflationary unless protocol changes implement burning mechanisms. This nuance matters for investors evaluating Bitcoin’s long-term value proposition.

The next section examines why even Ethereum’s fee-burning model falls short of creating genuine deflation, and what actually qualifies an asset as deflationary in practice.

Ethereum is not deflationary

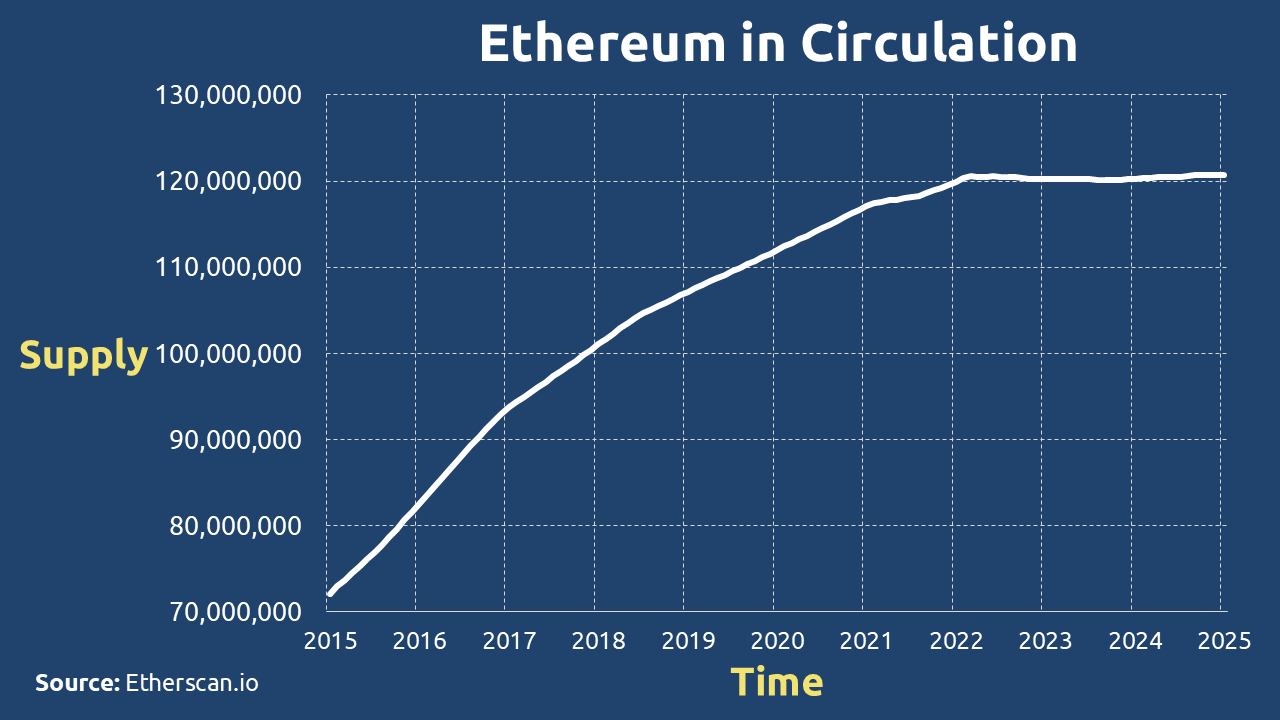

The 2021 London hard fork introduced EIP-1559, a fundamental redesign of Ethereum’s fee market that partially addressed the network’s inflation problem. Under this new system, each transaction now burns a base fee while paying a priority fee to validators. While this mechanism has significantly reduced ETH’s inflation rate from its pre-fork average of 8.3% to just 0.7%, the network has not achieved true deflation.

The critical distinction lies in Ethereum’s dual monetary flows: while transaction fees are continuously burned, new ETH enters circulation through staking rewards. This creates a delicate equilibrium where supply growth has stabilized but hasn’t consistently decreased. Even during periods of high network activity when burning temporarily outpaces issuance, Ethereum’s long-term supply trajectory remains inflationary by design.

Furthermore, the system contains inherent balancing mechanisms that prevent sustained deflation. Should too many validators exit due to reduced rewards, the protocol would automatically increase issuance to maintain network security. This self-correcting feature means Ethereum’s monetary policy actively resists persistent supply contraction.

The data clearly shows that while EIP-1559 successfully transformed Ethereum from a high-inflation to a low-inflation asset, it did not create the conditions for genuine deflation. True deflation would require not just fee burning, but a structural guarantee of permanent supply reduction – something Ethereum’s current design does not provide.

This nuanced understanding matters for investors and users. While Ethereum’s controlled inflation represents a major improvement over its previous monetary policy, conflating this with deflation creates unrealistic expectations about the asset’s scarcity profile. The network has achieved monetary stability, not artificial scarcity.

XRP: The Deflationary Exception Among Major Cryptos

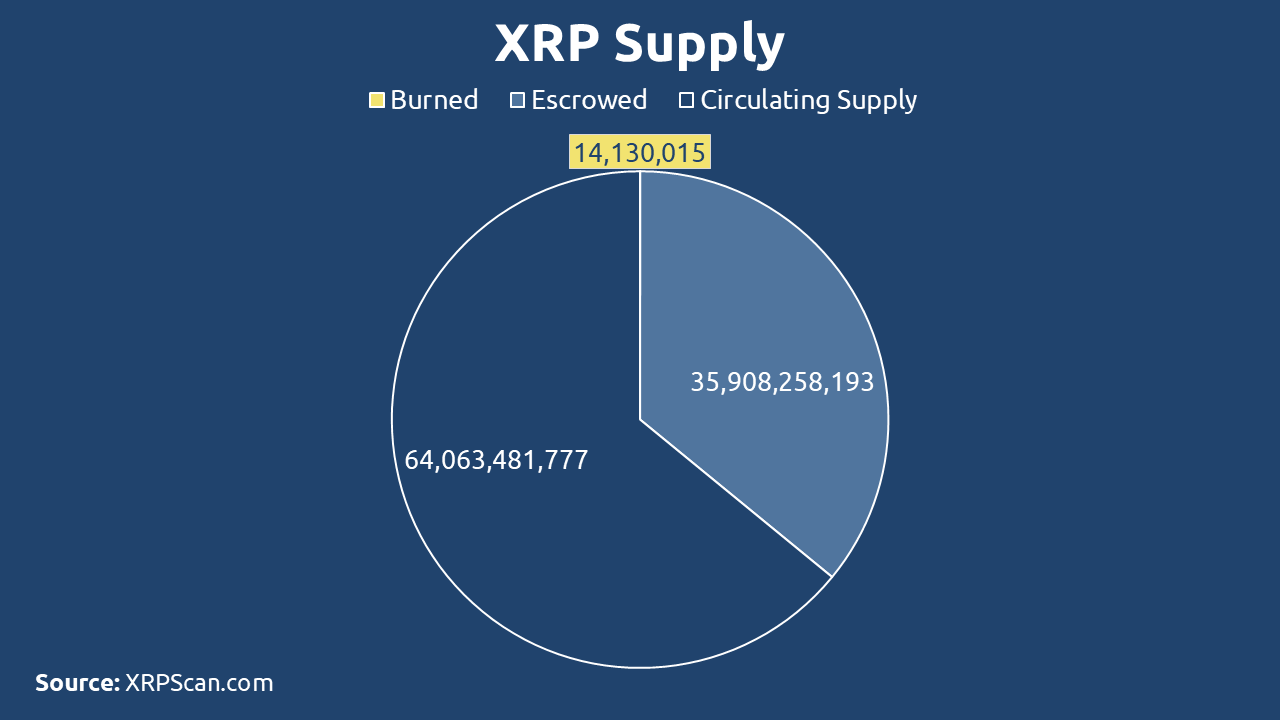

Within the top 10 cryptocurrencies by market capitalization, XRP stands apart through its unique deflationary mechanism. Unlike Bitcoin or Ethereum, XRP’s protocol systematically reduces its total supply through transaction burns. Each XRP transaction permanently destroys a small amount of the cryptocurrency – starting from a minimum of 0.000001 XRP – creating a gradual but persistent supply contraction.

Transaction data reveals the practical implications of this design. According to BitInfoCharts, the XRP network has averaged 677,374 daily transactions since 2013. At the minimum burn rate, this would theoretically remove about 3,112 XRP from circulation. However, actual burn figures tell a more substantial story – XRPScan reports over 14 million XRP burned as of July 2025, representing approximately 0.014% of the total 100 billion XRP supply.

A closer examination of XRP’s supply distribution reveals an accounting anomaly worth noting.

| XRP Quantity | |

| Burned | 14,130,015 |

| Escrowed | 35,908,258,193 |

| Circulating | 64,063,481,177 |

| Total | 99,985,869,985 |

Source: XRP Scan

The sum of burned, escrowed, and circulating XRP amounts to 99,985,869,985 – leaving a 14,130,015 XRP discrepancy that precisely matches the reported burn figure. This suggests potential double-counting in the burned supply calculation that merits clarification from XRP.

Despite this accounting question, XRP’s fundamental economics remain distinctly deflationary. The protocol’s built-in burn mechanism ensures continuous supply reduction, however gradual. At current burn rates, it would take approximately 891 years to remove just 1% of total supply – a pace that, while slow, still qualifies XRP as the only major cryptocurrency with programmatic deflation.

Gold – The Inflationary “Hard Asset”

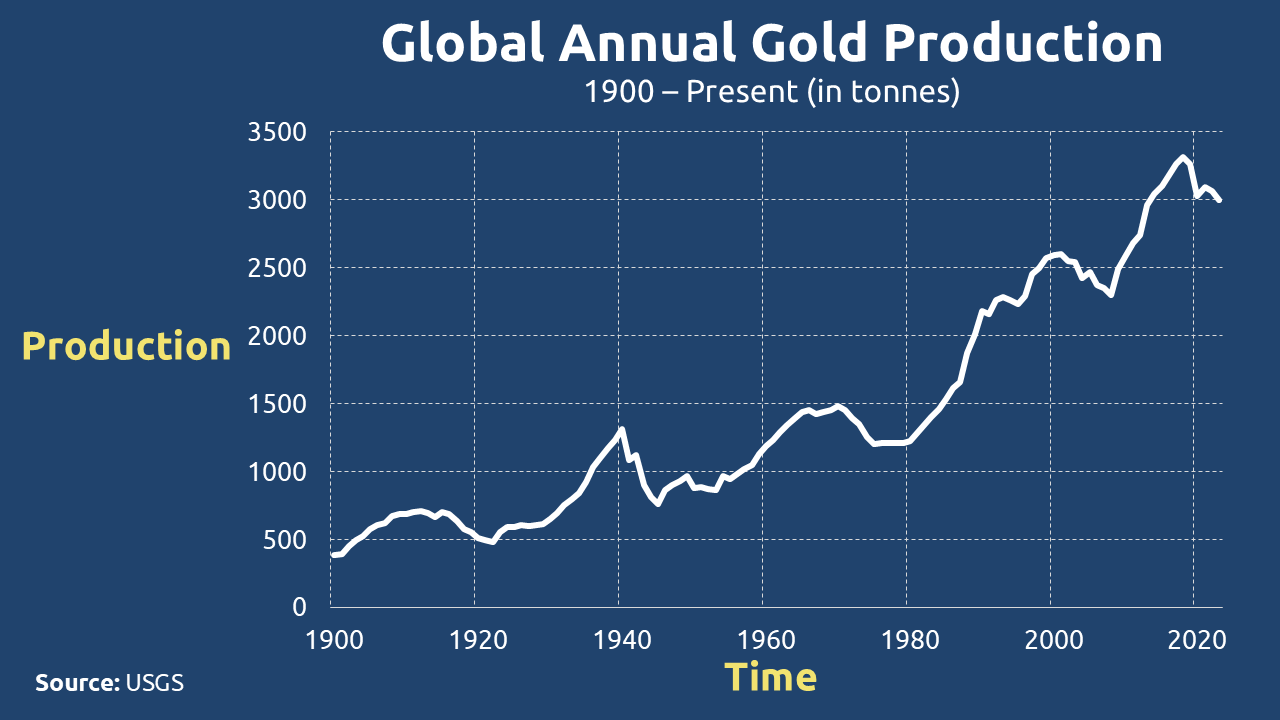

A persistent misconception among cryptocurrency advocates suggests gold operates as a deflationary asset. However, historical production data reveals the opposite truth: gold remains fundamentally inflationary, with its supply steadily growing year after year.

According to USGS, the global gold production has expanded sixfold since 1900; rising from under 500 tonnes annually to surpassing 3,000 tonnes in 2025. This consistent supply growth directly contradicts claims of gold being deflationary.

Some attempt to argue that gold becomes deflationary when measured against population growth. This flawed reasoning confuses relative scarcity with absolute supply mechanics. While there may be less gold per capita over time, the total above-ground supply continues expanding. Moreover, projecting future population trends introduces speculative variables that shouldn’t define an asset’s fundamental classification.

Key Takeaways

✅ Bitcoin: Disinflationary (slowing issuance, but still inflating until year 2140).

✅ Ethereum: Near-zero inflation (but not yet deflationary).

✅ XRP: Technically deflationary (but burns are negligible).

❌ Gold: Inflationary (supply grows yearly).

This discussion naturally leads to an important question: if neither Bitcoin, Ethereum, nor gold qualify as truly deflationary, which assets actually meet this standard? The answer reveals why genuine deflation remains exceptionally rare in both traditional and crypto markets – a topic we’ll explore in depth in our next analysis.